Don’t Let Student Loans Hold You Back from Homeownership

Mortgage

Mortgage

Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one of them and you're wondering:

Having questions like these is normal, especially when you’re thinking about making such a big purchase. But you should know, you may be putting your homeownership goals on the backburner unnecessarily.

In the simplest sense, what you want to know is can you still buy your first home if you have student debt. Here’s what Yahoo Finance says:

" . . . student loans don’t have to get in your way when it comes to becoming a homeowner. With the right approach and an understanding of how debt impacts your home-buying options, buying a house when you have student loans is possible."

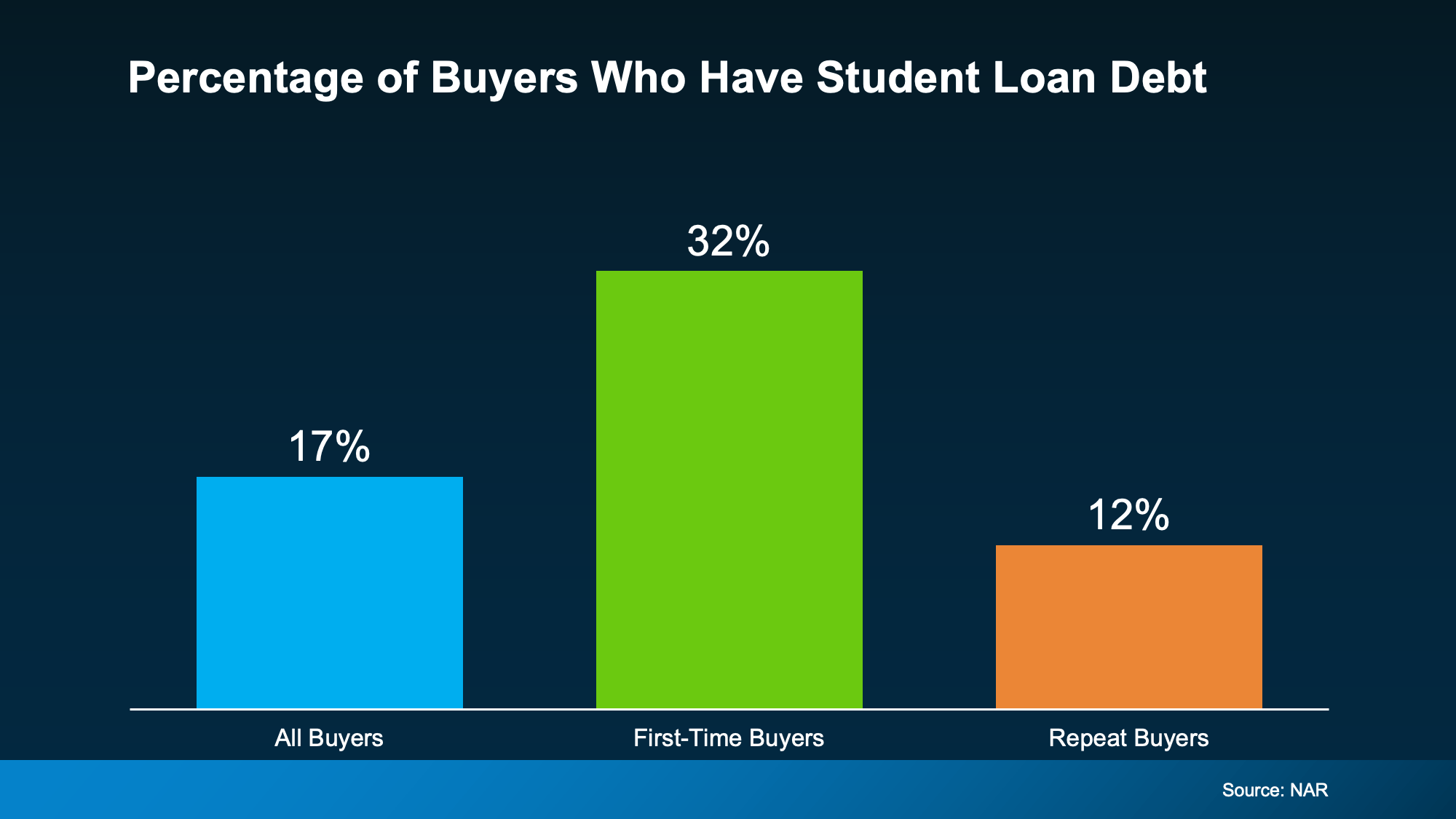

And the data backs this up. An annual report from the National Association of Realtors (NAR), shows that 32% of first-time buyers had student loan debt (see graph below):

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median student loan debt was $30,000. As an article from Chase says:

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median student loan debt was $30,000. As an article from Chase says:

“It’s important to note that student loans usually don’t affect your ability to qualify for a mortgage any differently than other types of debt you have on your credit report, such as credit card debt and auto loans.”

If your income is steady and your overall finances are solid, homeownership can still be within reach. So, having student loans doesn’t necessarily mean you have to wait to buy a home.

Having student loans doesn’t mean buying a home is off the table. Before you count yourself out, talk to a lender to get a clearer picture of what you can afford and how close you are to taking the first step toward homeownership.

Stay up to date on the latest real estate trends.

Mortgage

According to Realtor.com, this October will have the most buyer-friendly conditions of any month in 2025

Mortgage

Both of the top concerns for buyers are seeing some movement

Mortgage

Knowing your numbers can go a long way and help you feel confident about your purchase

Mortgage

Let’s talk about what your house is worth, and what it could unlock for you today.

New Listing

3 beds + den | 2 baths | 2,880 sq ft

Mortgage

What really matters is what’s happening in your town and your neighborhood.

Event

🏡 Trust Us, This Will Be Fun! 🏡

Mortgage

Lower rates, slower price growth, and stronger wages might make the numbers finally work for you this fall.

New Listing

4 beds | 2.5 baths | 2,678 sq ft

You’ve got questions and we can’t wait to answer them.