Don’t Miss Out on the Growing Number of Down Payment Assistance Programs

Mortgage

Mortgage

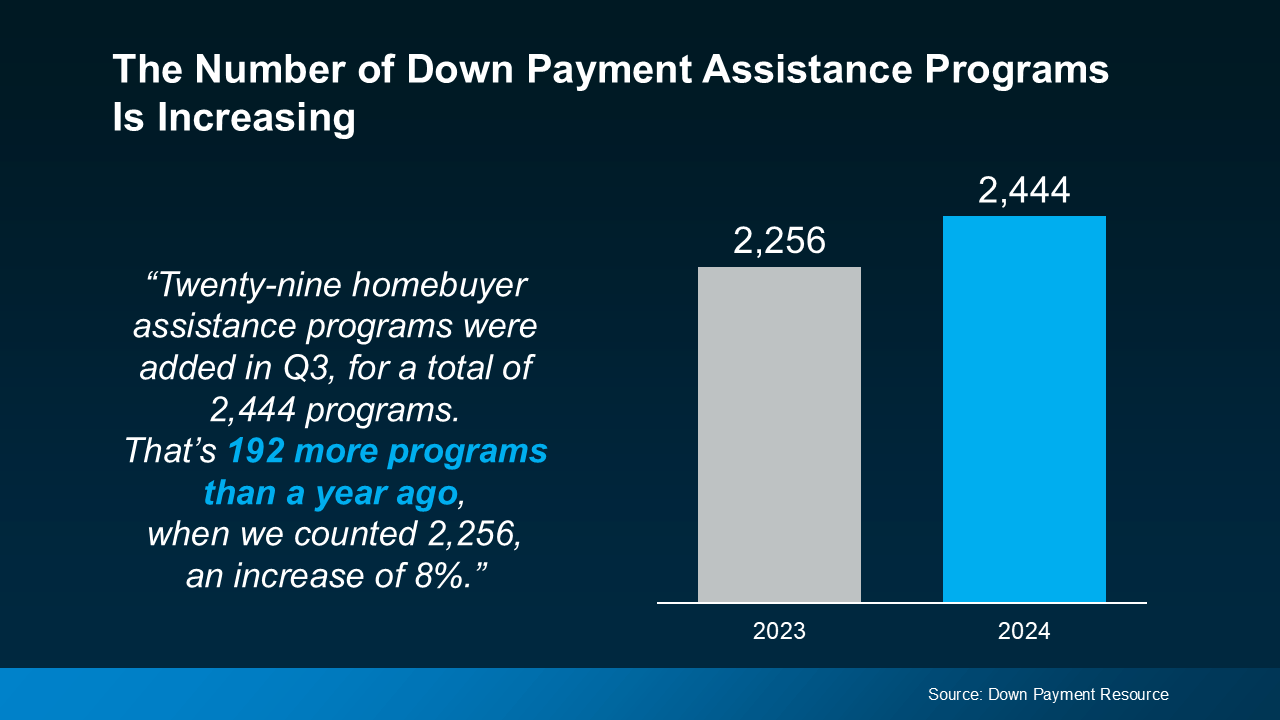

With rising home prices and volatile mortgage rates, it’s important you know about every resource that could help make buying a home possible. And one thing you’ll want to be aware of is just how much the number of down payment assistance (DPA) programs has grown lately.

Take a look at the graph below to see how many new programs have been added in the last year, according to data from Down Payment Resource:

More Programs, More Opportunities for You

More Programs, More Opportunities for YouSo, what does this increase mean for you? With more programs available, there’s a higher likelihood that one of them could help you reach your homeownership goals.

And these programs aren’t small-scale help either – the benefits can go a long way toward covering a chunk of your costs. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“We are pleased to see a growing number of these programs, and think they are becoming a targeted way to help first-time and first-generation homebuyers struggling to save for a down payment get into a home they can afford. Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine being able to qualify for $17,000 toward your down payment—that’s a big boost, especially if you’re looking to buy your first home. With that level of help, buying a home may be more within reach than you think.

But it’s worth calling out that the growth in DPA options isn’t just focused on first-time and first-generation buyers. Many of the new programs are also aimed at supporting affordable housing initiatives, which include manufactured and multi-family homes. This means that more people, and a wider variety of home types, can qualify for down payment assistance, making it easier for you to find an option that fits your needs.

With so many DPA programs out there, you need to make sure you’re finding the right one for you. That’s why it’s key to lean on your real estate and lending professionals for guidance. The Mortgage Reports says:

“The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out.”

Your loan officer or real estate agent will know what’s available in your area and can point you toward programs that align with your goals.

With more down payment assistance programs than ever before, now’s a great time to explore how these options can help on your homebuying journey. Let’s work together to make sure you’ve got a team of expert advisors in place to see which DPA programs could be a fit for you.

Stay up to date on the latest real estate trends.

Mortgage

In most cases, the difference typically comes down to the strategy behind the sale, not the house itself

Mortgage

People don’t buy homes just for financial reasons

Mortgage

The vast majority of the country is actually seeing prices rise

Mortgage

January may actually be the best time of year for budget-conscious buyers

Mortgage

The housing market hasn’t felt this energized in a long time

Mortgage

Small Flexibility, Big Payoff

Mortgage

The more money you put down, the less you need to finance at today’s rates

Mortgage

Less competition from other sellers and more motivated buyers

New Listing

Four 50'x100' vacant lots

You’ve got questions and we can’t wait to answer them.