Here’s What a Recession Could Mean for the Housing Market

Mortgage

Mortgage

Recession talk is all over the news, and the odds of a recession are rising this year. And that leaves people wondering what would happen to the housing market if we do go into a recession.

Let’s take a look at some historical data to show what’s happened in housing for each recession going all the way back to the 1980s.

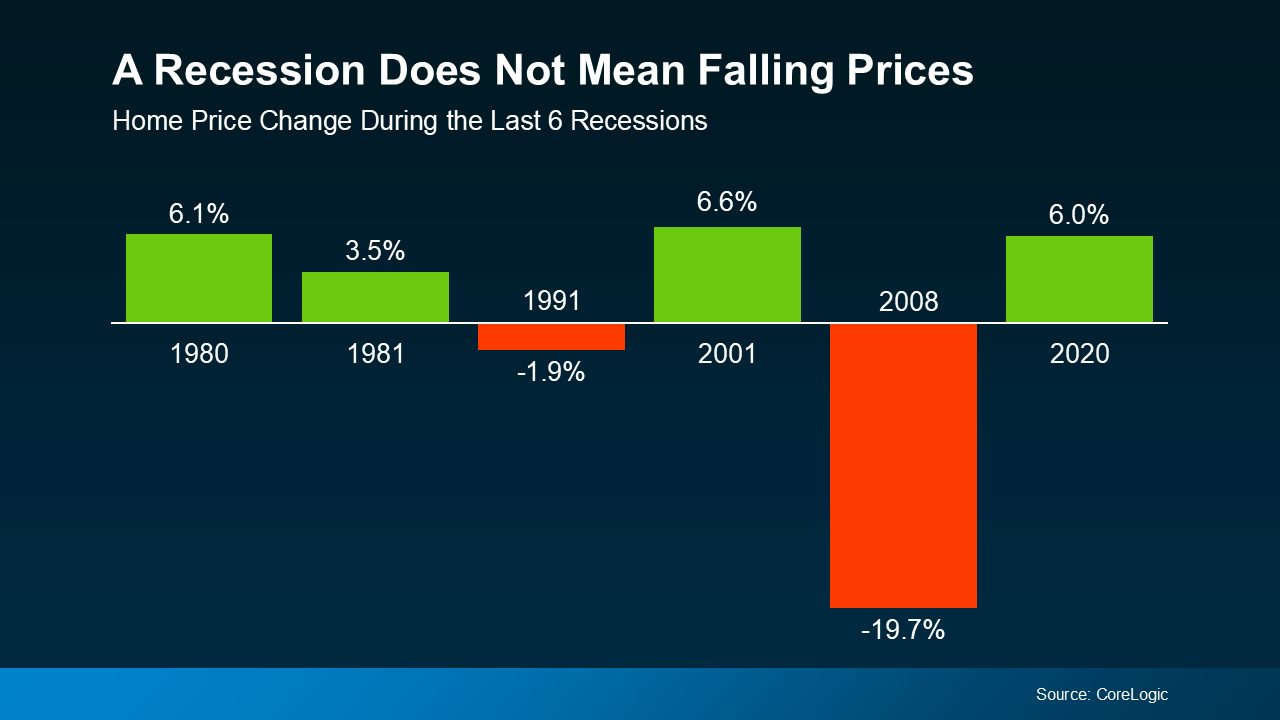

Many people think that if a recession hits, home prices will fall like they did in 2008. But that was an exception, not the rule. It was the only time we saw such a steep drop in prices. And it hasn’t happened since.

In fact, according to data from CoreLogic, in four of the last six recessions, home prices actually went up (see graph below):

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

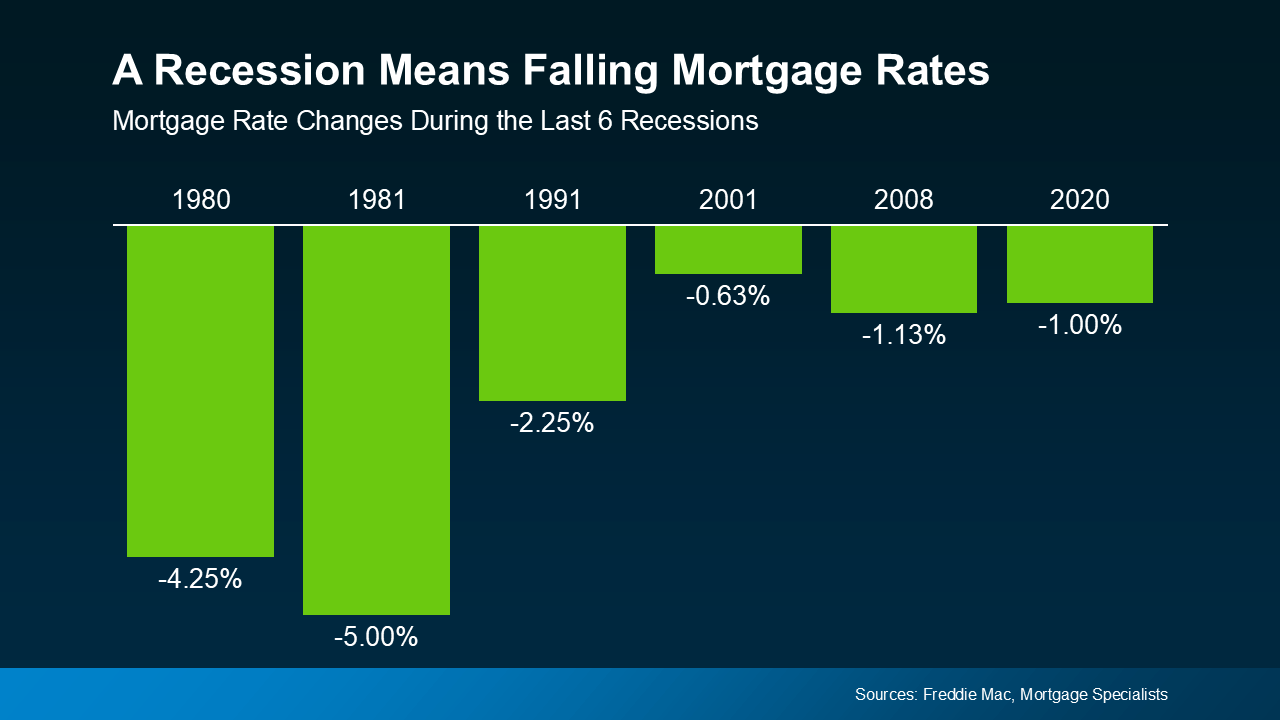

While home prices tend to stay on their current path, mortgage rates usually drop during economic slowdowns. Again, looking at data from the last six recessions, mortgage rates fell each time (see graph below):

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

The answer to the recession question is still unknown, but the odds have gone up. But that doesn’t mean you have to wonder about the impact on the housing market – historical data tells us what usually happens.

When you hear talk about a possible recession, what concerns or questions come to mind about buying or selling a home?

Stay up to date on the latest real estate trends.

Mortgage

In most cases, the difference typically comes down to the strategy behind the sale, not the house itself

Mortgage

People don’t buy homes just for financial reasons

Mortgage

The vast majority of the country is actually seeing prices rise

Mortgage

January may actually be the best time of year for budget-conscious buyers

Mortgage

The housing market hasn’t felt this energized in a long time

Mortgage

Small Flexibility, Big Payoff

Mortgage

The more money you put down, the less you need to finance at today’s rates

Mortgage

Less competition from other sellers and more motivated buyers

New Listing

Four 50'x100' vacant lots

You’ve got questions and we can’t wait to answer them.