Home Values Rise Even as Median Prices Fall

Mortgage

Mortgage

Recent headlines have been buzzing about the median asking price of homes dropping compared to last year, and that’s sparked plenty of confusion. And as a buyer or seller, it’s easy to assume that means prices are coming down. But here’s the catch: those numbers don’t tell the full story.

Nationally, home values are actually rising, even if the median price is down a bit. Let’s break down what’s really happening so you can make sense of the market without getting caught up in the fear the headlines create.

The biggest reason for the dip in median price is the size of homes being sold. The median price reflects the middle point of all the homes for sale at any given time. And that’ll be affected by the mix of homes on the market.

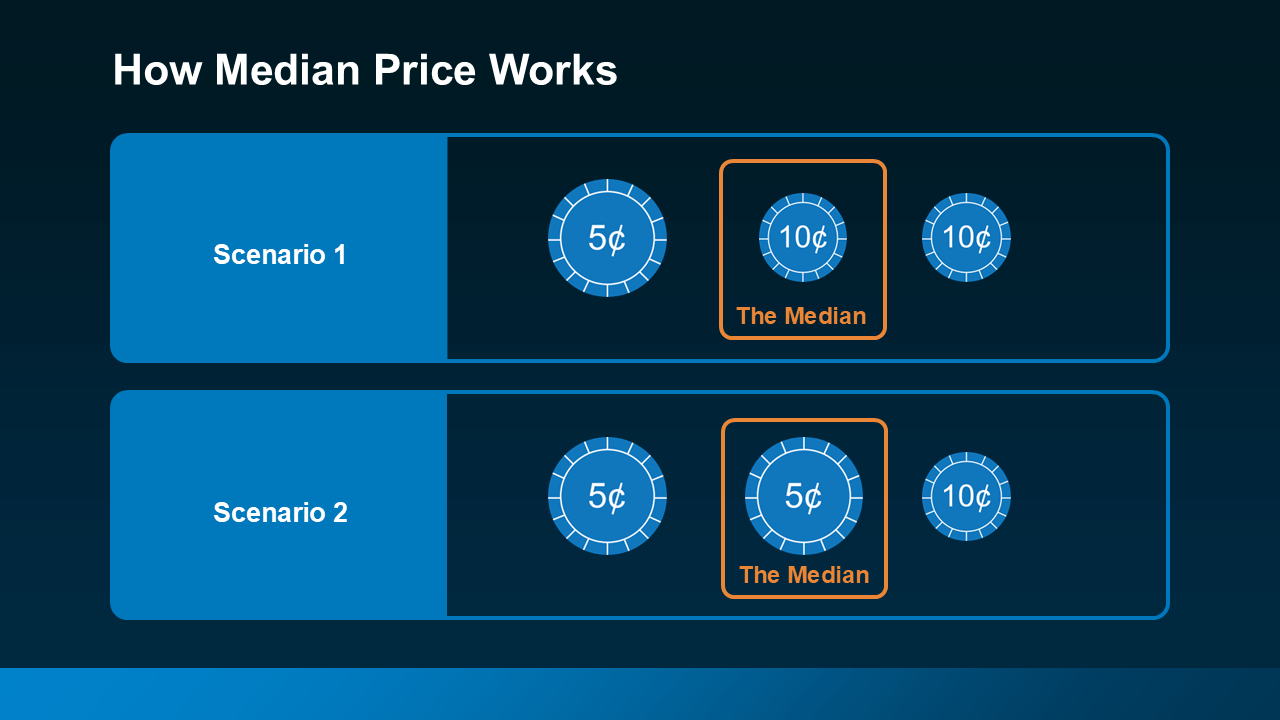

To show you how this works, here’s a simple explanation of a median (see visual below). Let’s say you have three coins in your pocket, and you decide to line them up according to their value from low to high. If you have one nickel and two dimes, the median (the middle one) is 10 cents. If you have two nickels and one dime, the median is now five cents.

In both cases, a nickel is still worth five cents and a dime is still worth 10 cents. The value of each coin didn’t change. The same is true for housing.

In both cases, a nickel is still worth five cents and a dime is still worth 10 cents. The value of each coin didn’t change. The same is true for housing.

Right now, there’s a greater number of smaller, less expensive homes on the market, and that’s bringing the overall median price down. But that doesn’t mean home values are declining.

As Danielle Hale, Chief Economist at Realtor.com, explains:

“The share of inventory of smaller and more affordable homes has grown, which helps hold down the median price even as per-square-foot prices grow further.”

And here’s the data to prove it.

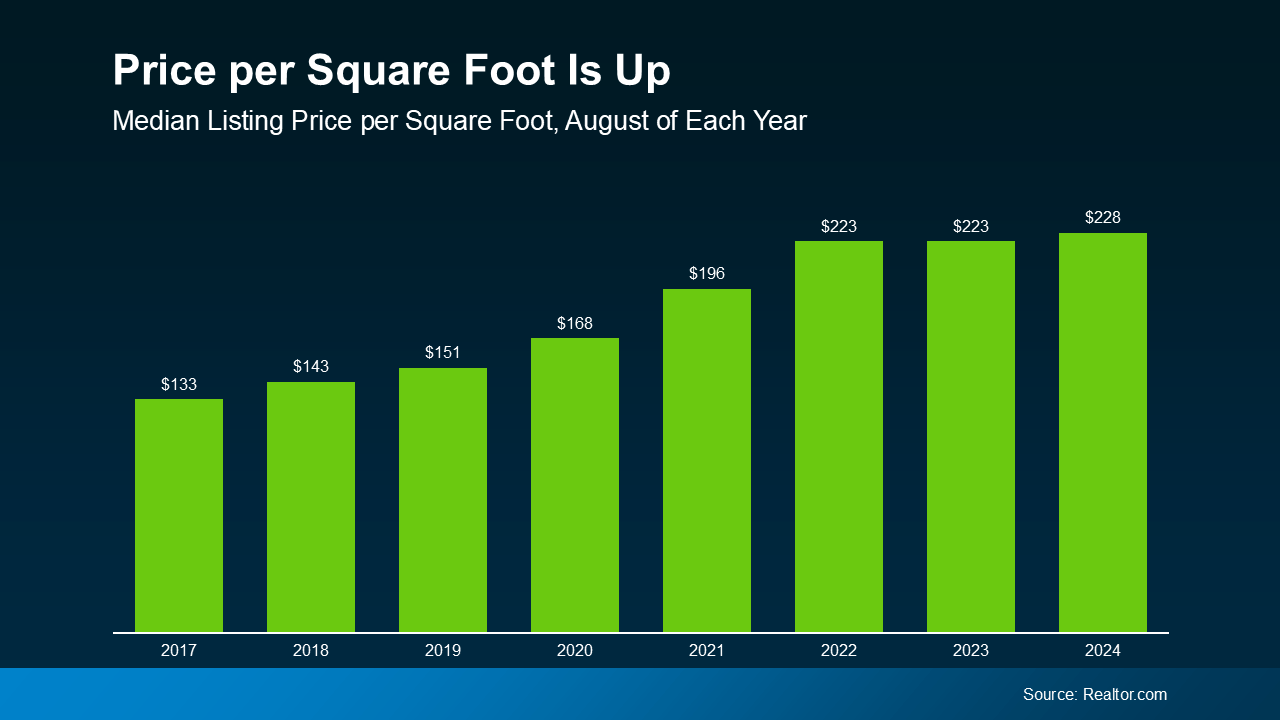

One of the best ways to measure home values is by looking at the price per square foot. That’s because it shows how much you're paying for the space inside the home.

The median asking price doesn't take into account the size of different homes, so it may not always reflect the true value. And the latest national price per square foot data shows home values are still increasing, even though the median asking price has dropped (see graph below).

As Ralph McLaughlin, Senior Economist at Realtor.com, explains:

As Ralph McLaughlin, Senior Economist at Realtor.com, explains:

“When a change in the mix of inventory toward smaller homes is accounted for, the typical home listed this year has increased in asking price compared with last year.”

This means that while smaller homes are affecting the median price, the average home’s value is still rising. According to the Federal Housing Finance Agency (FHFA):

“Nationally, the U.S. housing market has experienced positive annual appreciation each quarter since the start of 2012.”

So, while headlines may make it sound like prices are crashing, you don’t have to worry. With a closer look and more reliable data, you can see that prices are still climbing nationally.

But it’s important to remember that home prices can vary by region. While national trends provide a big-picture view, local markets may be experiencing different conditions. A trusted agent is the best resource to explain what’s happening in your area.

The decrease in median price is not the same as a decrease in home values. The median asking price is down mostly due to the mix of smaller, less expensive homes on the market.

The important thing to focus on is the price per square foot, which is a better indicator of overall market value—and those prices are still going up. If you have questions about what home prices are doing in our area, feel free to reach out.

Stay up to date on the latest real estate trends.

Mortgage

Momentum is quietly building in the housing market.

Mortgage

Housing market conditions, your own personal situation and your finances are all things to consider.

Mortgage

Here’s what the experts are saying you have to look forward to.

Mortgage

People don’t buy homes just for financial reasons

Mortgage

In most cases, the difference typically comes down to the strategy behind the sale, not the house itself

Mortgage

The vast majority of the country is actually seeing prices rise

Mortgage

January may actually be the best time of year for budget-conscious buyers

Mortgage

The housing market hasn’t felt this energized in a long time

Mortgage

Small Flexibility, Big Payoff

You’ve got questions and we can’t wait to answer them.