Homeowners Gained $28K in Equity over the Past Year

Mortgage

Mortgage

If you own a home, your net worth has probably gone up a lot over the past year. Home prices have been rising, which means you're building equity much faster than you might think. Here’s how it works.

Equity is the current value of your home minus what you owe on the loan.

Over the past year, there have still been more people wanting to buy than there are homes available for sale, and that’s pushed prices up. That rise in prices has translated directly into increasing equity for homeowners.

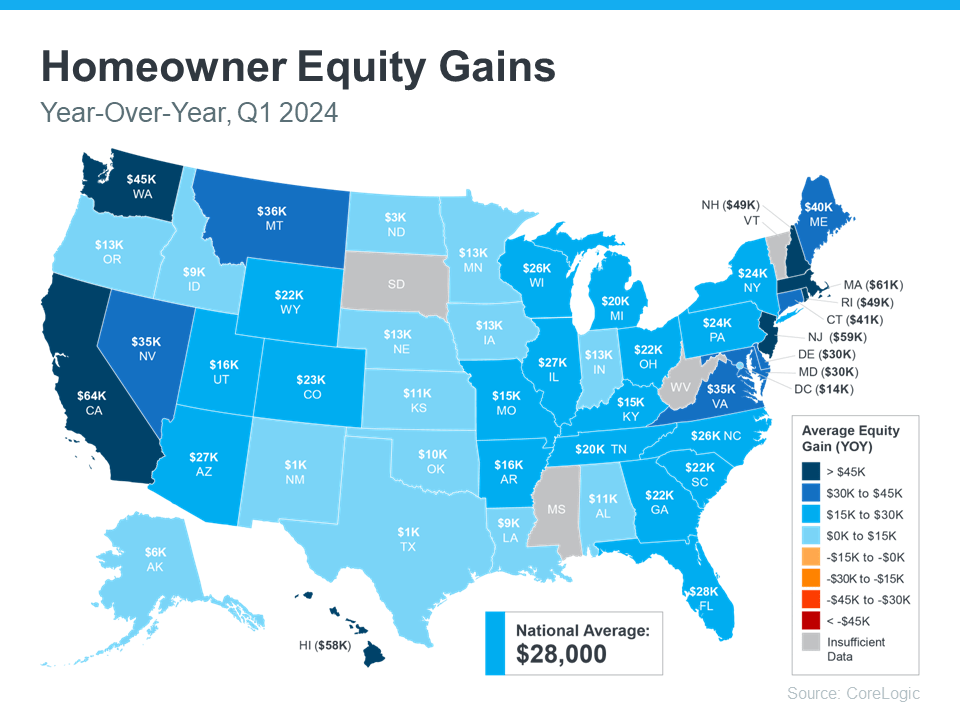

According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner's equity has grown by $28,000 in the last year alone.

That's the national average, so if you want to see what's happening in your state, check out the map below. It uses data from CoreLogic to show how much equity has grown in each state over the past year. You’ll notice every single state with sufficient data saw annual equity gains:

If you bought your house before the pandemic, the equity news is even better. According to data from Realtor.com, home prices shot up by 37.5% from May 2019 to May 2024, meaning your home's value has likely increased significantly. Ralph McLaughlin, Senior Economist at Realtor.com, says:

“Homeowners have seen extraordinary gains in home equity over the past five years.”

To give context to how much equity can stack up over time, Selma Hepp, Chief Economist at CoreLogic, explains the total equity the typical homeowner has today:

“With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner.”

With how prices skyrocketed a few years ago, and the ongoing price growth today, homeowners clearly have substantial equity built up – and that has some serious benefits.

You could use it to start a business, fund an education, or even to help you afford your next home. When you sell, the equity you’ve built up comes back to you, and may be enough to cover a big part – or even all – of your next home’s down payment.

If you're planning to move, the equity you've gained can really help. Curious about how much you have and how you can use it to help pay for your next home? Let's connect.

Stay up to date on the latest real estate trends.

Mortgage

You can work with a trusted lender and take steps that’ll help you get the best rate possible

Mortgage

Spring is the busiest time in real estate – and there’s still time to take full advantage of that momentum

Mortgage

Let’s connect to make sure your house is priced to pull people in, not push them away

New Listing

3 beds | 2 baths | 1,338 sq ft

Mortgage

Getting pre-approved doesn’t mean you have to buy a house today

Mortgage

The truth is: the housing market isn’t about to crash – it’s just shifting

Mortgage

While your tax refund may not be enough to change the game, it can help give your homebuying fund a boost

Mortgage

Let’s work together to make sure your offer stands out.

Mortgage

Here’s what the data tells us

You’ve got questions and we can’t wait to answer them.