How Co-Buying a Home Helps with Affordability Today

Mortgage

Mortgage

Buying a home in today’s market can feel like an uphill battle – especially with home prices and mortgage rates putting pressure on your budget. If you’re feeling stuck, co-buying could be one way to help you get your foot in the door. Freddie Mac says:

“If you are an aspiring homeowner, buying a home with your family or friends could be an option.”

But there are some things you'll want to consider first. Let’s explore why co-buying is gaining popularity right now among some buyers and see if it may make sense for you too.

Co-buying means buying a home with someone like a friend, sibling, or even a group of people. And, with today’s high home prices and mortgage rates, it’s an option more people are turning to.

According to a survey done by JW Surety Bonds, nearly 15% of Americans have already co-purchased a home with someone, and another 48% would consider doing it.

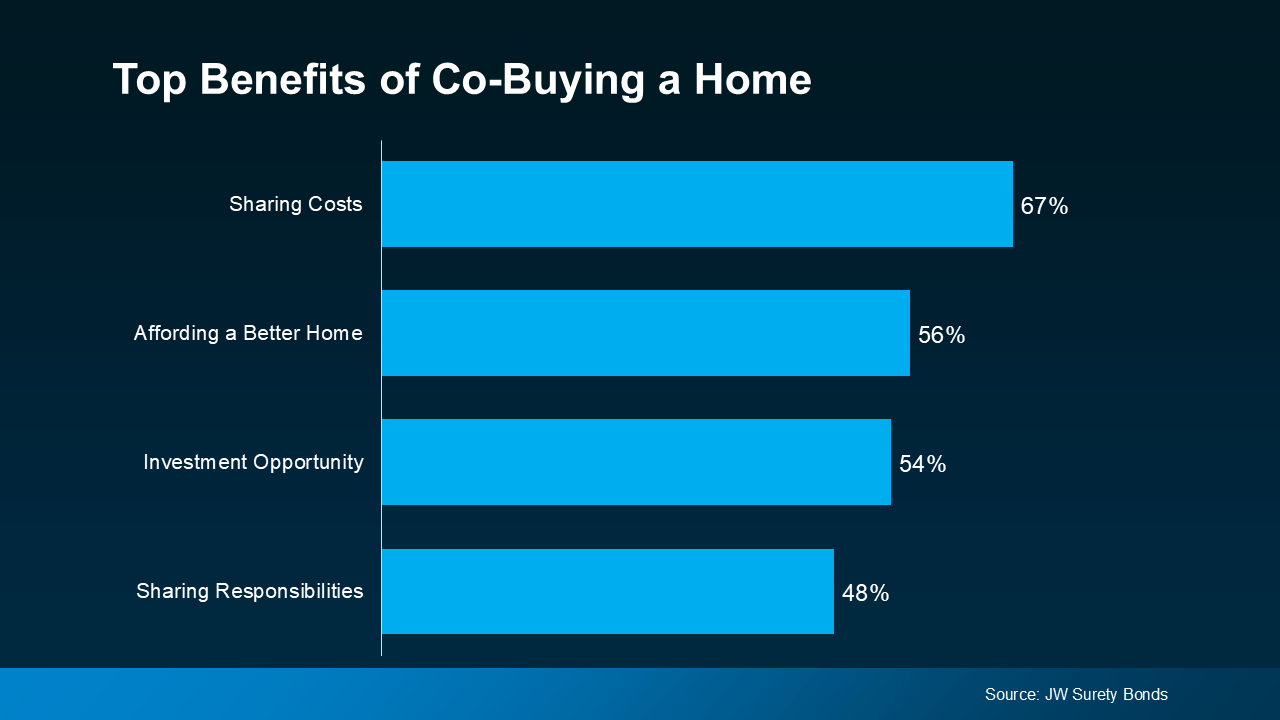

The same survey also asked people about the perks of co-buying a home. Here are some of the top responses (see graph below):

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.

Sharing Costs (67%): From saving for a down payment to managing monthly payments, buying a home is a big financial step. When you co-buy, you split these costs, making it easier to afford a home.

Affording a Better Home (56%): By pooling your financial resources, you may also be able to afford a larger or higher-quality home than you could have on your own. This may mean getting that extra bedroom, a bigger backyard, or living in a more desirable neighborhood.

Investment Opportunity (54%): Co-buying a home can also be an investment. You could buy a house with someone so you can rent out, which could help generate passive income.

Sharing Responsibilities (48%): Owning a home comes with a lot of responsibilities, including maintenance and upkeep and more. When you co-buy, you share these commitments, which can lighten the load for everyone involved.

While co-buying has its benefits, there’s something else you need to consider before deciding if this approach is right for you. As Rocket Mortgage says:

“Buying a house with a friend or multiple friends might be a great way for you to achieve homeownership, but it’s not a decision you should make lightly. Before diving in, make sure you understand the financial and logistical hurdles you’ll face, as well as the human and emotional elements that might affect the purchase or, more importantly, your relationship.”

Basically, make sure you and your co-buyer are on the same page about things like how costs will be split, who will handle what responsibilities, and what will happen if one of you wants to sell your share of the home in the future. Leaning on an expert can help you weigh the pros and cons to make that conversation easier.

If you're looking to get your foot in the door but are having a tough time with today’s affordability challenges, co-buying could be an option to make your move happen. But, it’s important to plan carefully and make sure all parties are clear on the details. To figure out if co-buying makes sense for you, let’s connect.

Stay up to date on the latest real estate trends.

Mortgage

Momentum is quietly building in the housing market.

Mortgage

Housing market conditions, your own personal situation and your finances are all things to consider.

Mortgage

Here’s what the experts are saying you have to look forward to.

Mortgage

People don’t buy homes just for financial reasons

Mortgage

In most cases, the difference typically comes down to the strategy behind the sale, not the house itself

Mortgage

The vast majority of the country is actually seeing prices rise

Mortgage

January may actually be the best time of year for budget-conscious buyers

Mortgage

The housing market hasn’t felt this energized in a long time

Mortgage

Small Flexibility, Big Payoff

You’ve got questions and we can’t wait to answer them.