Is an Accessory Dwelling Unit Right for You? Here’s What To Know

Mortgage

Mortgage

Are you having a hard time finding the right home in your budget? Or maybe you already own a home but could use some extra income or a designated space for aging loved ones. Either way, accessory dwelling units (ADUs) could be the smart solution you’ve been looking for in today’s market.

According to Fannie Mae, an ADU is a small, separate living space that’s on the same lot as a single-family home. It must include its own areas for living, sleeping, cooking, and bathrooms independent of the main house. And they can take shape in a few different ways. Fannie Mae adds, an ADU can be:

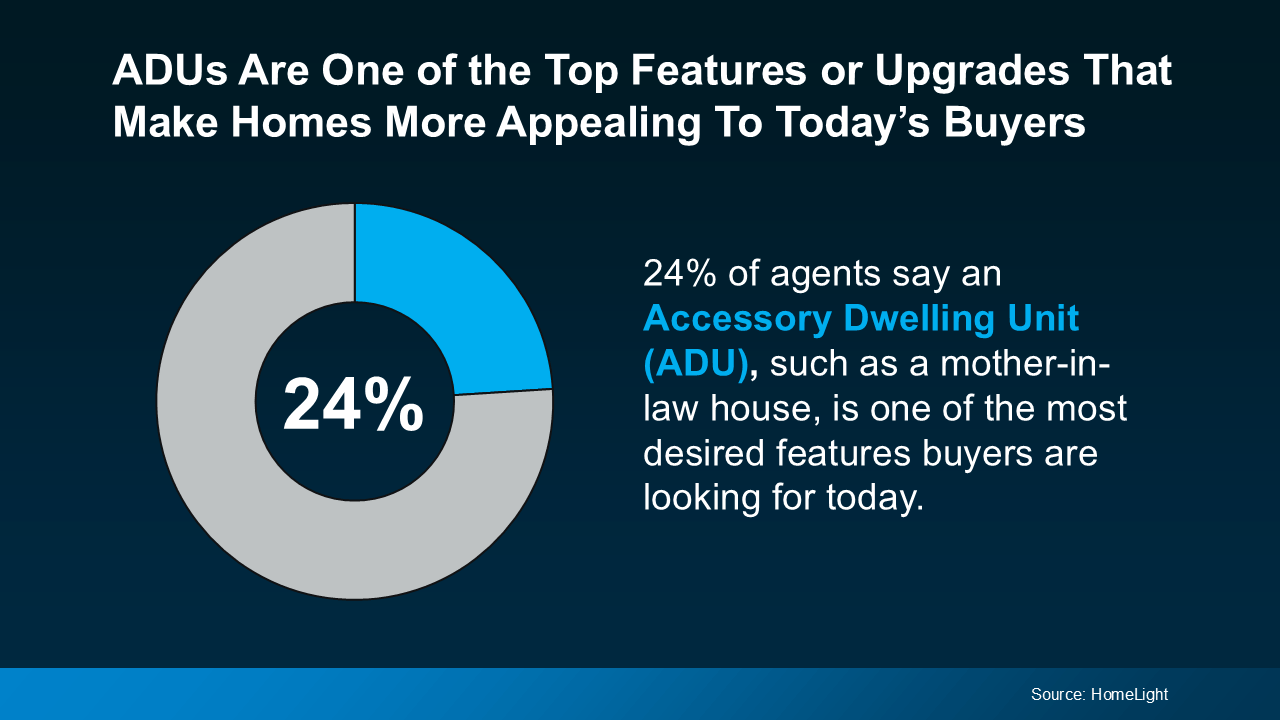

ADUs are growing in popularity as more people discover why they’re so practical. In fact, a recent survey shows that 24% of agents say an ADU, such as a mother-in-law house, is one of the most desired features buyers are looking for right now.

The growing appeal makes sense. With rising costs all around you, an ADU can help supplement your income and ease some of the strain on your wallet. Whether you buy a home that has one already or you add one on, it gives you the option to rent out that portion of your home to help pay your mortgage.

The growing appeal makes sense. With rising costs all around you, an ADU can help supplement your income and ease some of the strain on your wallet. Whether you buy a home that has one already or you add one on, it gives you the option to rent out that portion of your home to help pay your mortgage.

Here are some of the other top benefits of ADUs, according to Freddie Mac and the AARP:

It’s worth noting that since an ADU exists on a single-family lot as a secondary dwelling, it typically can’t be sold separately from the primary residence. And while that’s changing in some states, regulations vary by location. So, connect with a local real estate expert for the most up-to-date guidance.

In today’s market, buying a home with an ADU or adding one to your current house could be worth considering. Just be sure to talk with a real estate agent who can explain local codes and regulations for this type of housing and what’s available in your area.

What’s your motivation for exploring ADUs?

Stay up to date on the latest real estate trends.

New Listing

4 beds | 3 full baths | 2,854 sq ft

New Listing

4 beds | 3 baths | 2,610 sq ft

New Listing

4 beds | 3.5 baths | 3,398 sq ft

Mortgage

It could mean paying less, dealing with less stress, and feeling less rushed

Mortgage

Affordability Is Finally Moving in the Right Direction

Mortgage

Don’t forget to plan ahead for your homeowner’s insurance

New Listing

2 bedrooms | 1 bathroom | 617 sq ft

Mortgage

Nearly 12,000 people will turn 65 every day for the next two years

Mortgage

The housing market in 2026 isn’t one-size-fits-all. It’s a year where local conditions matter more than ever.

You’ve got questions and we can’t wait to answer them.