Sellers: Don’t Let These Two Things Hold You Back

Mortgage

Mortgage

Many homeowners thinking about selling have two key things holding them back. That’s feeling locked in by today’s higher mortgage rates and worrying they won’t be able to find something to buy while supply is so low. Let’s dive into each challenge and give you some helpful advice on how to overcome these obstacles.

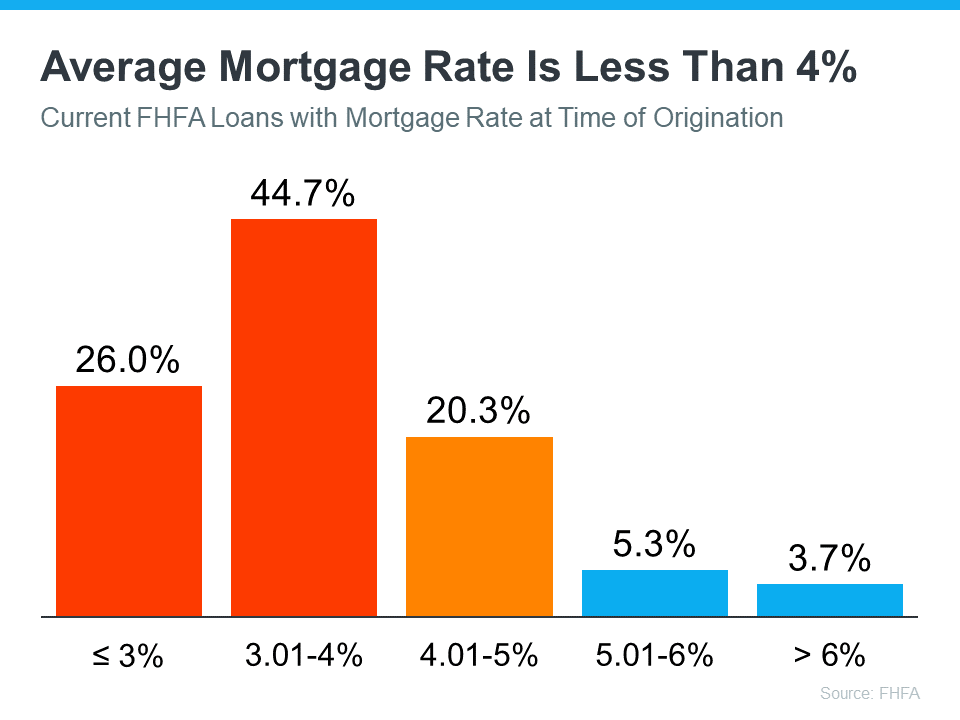

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

But today, the typical 30-year fixed mortgage rate offered to buyers is closer to 7%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as the mortgage rate lock-in effect.

But today, the typical 30-year fixed mortgage rate offered to buyers is closer to 7%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as the mortgage rate lock-in effect.

While experts project mortgage rates will gradually fall this year as inflation cools, that doesn’t necessarily mean you should wait to sell. Mortgage rates are notoriously hard to predict. And, right now home prices are back on the rise. If you move now, you’ll at least beat rising home prices when you buy your next home. And, if experts are right and rates fall, you can always refinance later if that happens.

When so many homeowners are reluctant to take on a higher rate, fewer homes are going to come onto the market. That’s going to keep inventory low. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Inventory will remain tight in the coming months and even for the next couple of years. Some homeowners are unwilling to trade up or trade down after locking in historically-low mortgage rates in recent years.”

Even though you know this limited housing supply helps your house stand out to eager buyers, it may also make you feel hesitant to sell because you don’t want to struggle to find something to purchase.

If fear you won’t be able to find your next home is the primary thing holding you back, remember to consider all your options. Looking at all housing types including condos, townhouses, and even newly built homes can help give you more to choose from. Plus, if you’re able to work fully remote or hybrid, you may be able to consider areas you hadn’t previously searched. If you can look further from your place of work, you may have more affordable options.

Instead of focusing on the challenges, focus on what you can control. Let’s connect so you’re working with a professional who has the experience to navigate these waters and find the perfect home for you.

Stay up to date on the latest real estate trends.

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

Mortgage

Most Americans think a recession is coming. But most experts don’t.

Mortgage

The listings that didn’t sell this year weren’t doomed. They just started with the wrong strategy.

You’ve got questions and we can’t wait to answer them.