The $280 Shift in Affordability Every Homebuyer Should Know

Mortgage

Mortgage

If you paused your plans to move because of high rates or prices, it may finally be time to take a second look at your numbers. Affordability is improving in 39 of the top 50 markets, according to First American. And that’s the 5th straight month where buying a home has started to get a little bit easier.

Let’s break this down into real dollars, so you can see the difference this could make for you (and your move).

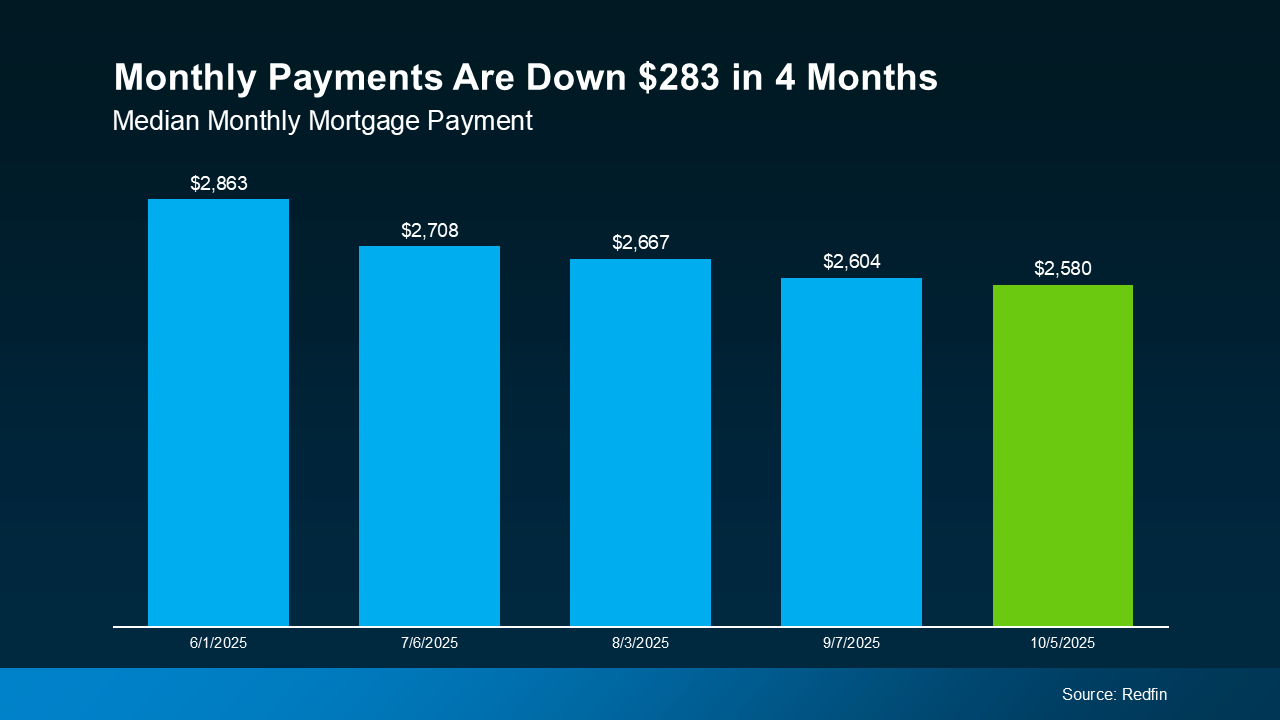

One of the clearest signs of this shift is in monthly payments. The latest data from Redfin shows mortgage payments on a median-priced home are now $283 lower than they were just a few months ago (see graph below):

This kind of monthly savings adds up fast, and totals nearly $3,400 over the course of a year.

This kind of monthly savings adds up fast, and totals nearly $3,400 over the course of a year.

While this isn’t enough to completely change the affordability game overnight, think about it this way. When you’re putting together a homebuying budget, a few hundred dollars could be the difference between being comfortable buying and feeling like money’s a bit tight.

And from a home-search perspective, it could even be enough to change the price point you can look at. According to Redfin:

“A borrower with a $3,000 monthly budget can now afford a $468,000 home, about $22,000 more than in June."

And that’s a big deal if you haven’t found a home you love in your price range yet. It gives you a little more flexibility to find the one that’s right for you.

Either way, that’s a big win.

Two key factors are working in your favor right now:

Both of those things help your bottom line and give you a bit of breathing room if you’re buying a home. As Andy Walden, Head of Mortgage and Housing Market Research at ICE Mortgage Technology, says:

“The recent pullback in rates has created a tailwind for both homebuyers and existing borrowers. We’re seeing affordability at a 2.5-year high . . .”

Whether you’re a first-time homebuyer or someone looking to move-up into a bigger house, the shifts happening this year could make your move possible. Connect with a trusted agent or lender to see what your monthly payment would look like at today’s rates.

For you, the savings could be the difference between “not yet” and “let’s go.”

Affordability is improving in many markets. And that resets the math on your move.

If you’ve been sitting on the sidelines, this is your cue to start looking again. Let’s run the local numbers together so you can get a rough estimate of how much more buying power you may have than you did just a few months ago.

Stay up to date on the latest real estate trends.

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

Mortgage

Most Americans think a recession is coming. But most experts don’t.

Mortgage

The listings that didn’t sell this year weren’t doomed. They just started with the wrong strategy.

You’ve got questions and we can’t wait to answer them.