The Latest Builder Trend: Smaller, Less Expensive Homes

Mortgage

Mortgage

Even though affordability is improving, buying a home can still feel tough right now. But here’s some good news: builders are focusing their efforts on building smaller homes, and they’re offering key incentives to buyers. And both of these things can be a big help if you're worried about finding a home that’s right for your budget.

During the pandemic, homebuyers were looking for larger homes—and many could afford them. Builders responded to that demand and created bigger spaces to help people with things like working from home, setting up home gyms, and having extra rooms for virtual school.

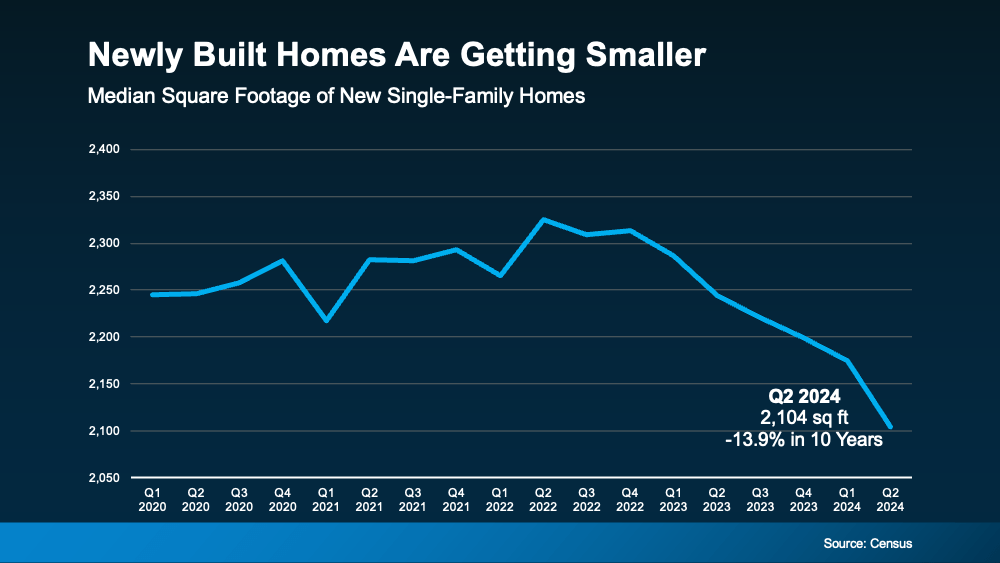

Now, with affordability as tight as it is, builders are turning their focus to smaller single-family homes. Data from the Census shows how significant this trend toward smaller new homes has been over the last couple of years (see graph below):

But why would builders want to build smaller homes right now? At the end of the day, builders are going to focus on building homes that meet current market demand – because they want to build what they know will sell. And the number one thing homebuyers are looking for right now is better affordability. Since smaller homes typically come with smaller price tags, both buyers and builders have shifted their focus to homes with less square footage. The National Association of Home Builders (NAHB) reports:

But why would builders want to build smaller homes right now? At the end of the day, builders are going to focus on building homes that meet current market demand – because they want to build what they know will sell. And the number one thing homebuyers are looking for right now is better affordability. Since smaller homes typically come with smaller price tags, both buyers and builders have shifted their focus to homes with less square footage. The National Association of Home Builders (NAHB) reports:

“. . . home buyers are looking for homes around 2,070 square feet, compared to 2,260 20 years ago.”

And according to Orphe Divounguy, Senior Economist at Zillow:

“Not only are cash-strapped buyers continually seeking out lower-cost options, but developers are changing what type and size of home they're producing to try and meet that need."

So, if you’re having a hard time finding something in your budget, it may be time to look at brand-new homes that have a smaller footprint. When you do, you may get a few other fringe benefits that can help on the affordability front – like price reductions or mortgage rate buy-downs.

According to the most recent data from Zonda, more than half of builders are offering incentives, some of which are mortgage rate buydowns. And those perks could help lower your future monthly housing payment too. John Burns, CEO of John Burns Research & Consulting, shares:

“The monthly payment matters more than anything else and builders have responded with smaller, more efficient homes.”

Not to mention, with new home construction, you’ll also get brand new everything, have fewer maintenance needs, and get some of the latest features available. That’s worth looking into, right?

With builders focusing on smaller homes, you may have more budget-friendly options when it matters most. If you're thinking about buying a home soon, let’s connect and see what’s available where you want to live.

Stay up to date on the latest real estate trends.

New Listing

Four 50'x100' vacant lots

Mortgage

More brand-new options are on the market right now, and builders are rolling out incentives

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

You’ve got questions and we can’t wait to answer them.