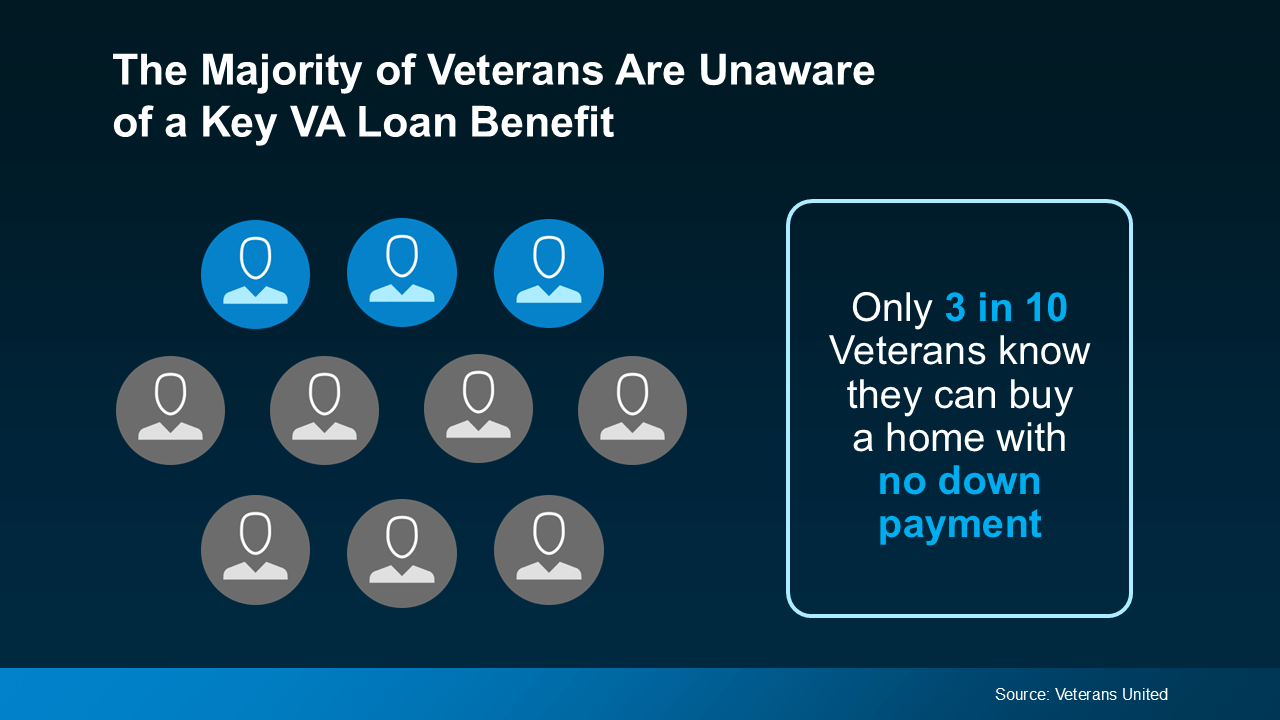

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

Mortgage

Mortgage

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment (see visual below):

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

“The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

VA home loans are designed to make homeownership a reality for those who have served our country. These loans come with the following benefits according to the Department of Veterans Affairs:

Your team of expert real estate professionals, including a local agent and a trusted lender, are the best resource to understand all the options and advantages available to help you achieve your homebuying goals.

Owning a home is a key part of the American Dream, and VA home loans are a powerful benefit for those who’ve served our country. Let’s connect to make sure you have everything you need to make confident decisions in the housing market.

Stay up to date on the latest real estate trends.

Mortgage

In most cases, the difference typically comes down to the strategy behind the sale, not the house itself

Mortgage

People don’t buy homes just for financial reasons

Mortgage

The vast majority of the country is actually seeing prices rise

Mortgage

January may actually be the best time of year for budget-conscious buyers

Mortgage

The housing market hasn’t felt this energized in a long time

Mortgage

Small Flexibility, Big Payoff

Mortgage

The more money you put down, the less you need to finance at today’s rates

Mortgage

Less competition from other sellers and more motivated buyers

New Listing

Four 50'x100' vacant lots

You’ve got questions and we can’t wait to answer them.