The Truth About Newly Built Homes and Today’s Market

Mortgage

Mortgage

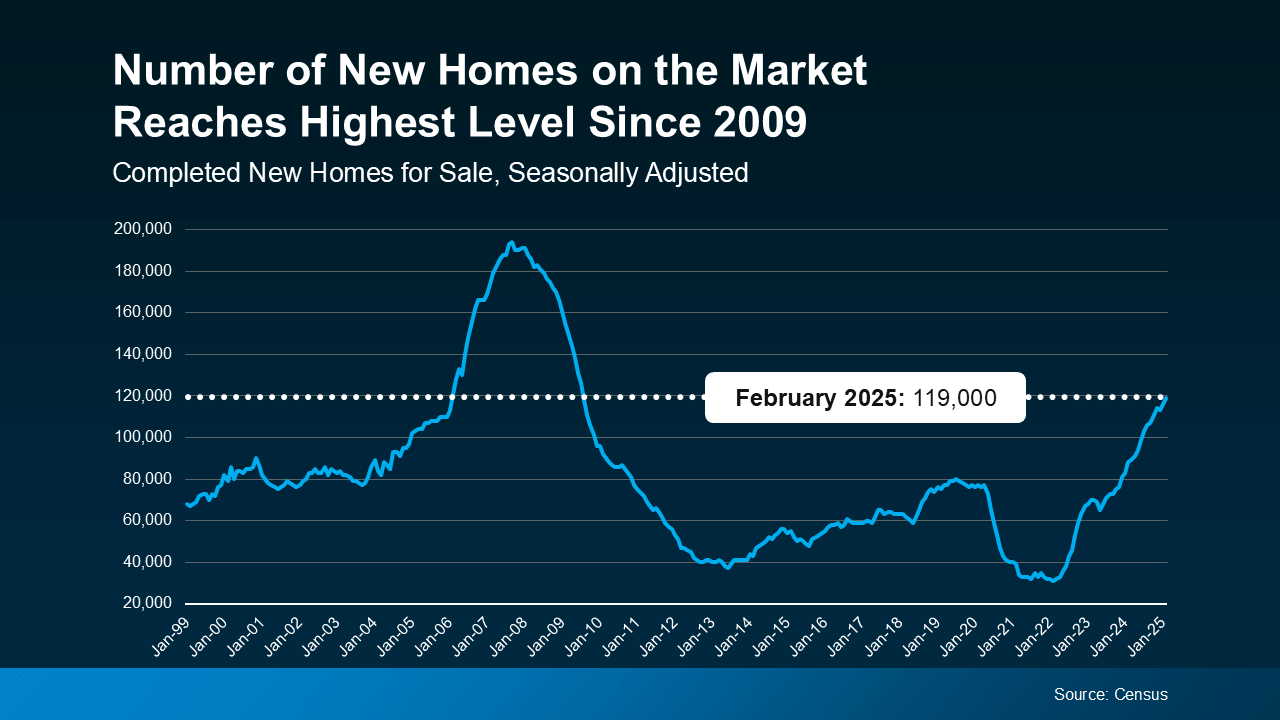

Headlines are talking about the inventory of new homes and how we’re back at the levels not seen since 2009. And maybe you’re reading that and thinking: oh no, here we go again. That’s because you remember the housing crash of the late 2000s and you’re worried we’re repeating the same mistakes.

But before you let fear take hold, remember: headlines are designed to be clickbait. And a lot of the time, they do more to terrify than clarify. That’s because they don’t always give you all the context you need. So, let’s take a step back and look at what the data really says.

While it’s true the number of new homes on the market has reached its highest level since 2009, that’s not a cause for alarm.

Here’s the context that matters most. When the data is turned into a graph, it’s clear the amount seen in 2009 wasn’t the peak of oversupply – not even close. That high point came earlier in 2007-2008. If anything, 2009 was when the number of new homes being built was really starting to slide back down (see graph below):

The overbuilding that contributed to the housing crash happened in the years leading up to 2008. Not in 2009. At that point, construction was already slowing down. So, saying we’ve hit 2009 levels isn't the same thing as saying we’re overbuilding like we did the last time.

The overbuilding that contributed to the housing crash happened in the years leading up to 2008. Not in 2009. At that point, construction was already slowing down. So, saying we’ve hit 2009 levels isn't the same thing as saying we’re overbuilding like we did the last time.

Here’s some more data to prove it to you. After the crash, builders pulled production way back. As a result, they built far fewer homes than the market needed. And that was a consistent problem that lasted for over a decade. That long stretch of underbuilding created a major housing shortage, which is still a challenge today.

The graph below uses Census data to show the number of new homes built each year over the past 52 years. You can clearly see the overbuilding leading up to the crash (in red), the period of underbuilding that followed (in orange), and how we’re only now getting back to a more normal level of construction:

Today’s situation is different. Builders aren’t overbuilding – they’re catching up.

In a recent article, Odeta Kushi, Deputy Chief Economist at First American, highlights this deficit and speaks to why the recent ramp-up in construction is actually good for today’s market, especially buyers:

“This means more homes on the market and more options for home buyers, which is good news for a housing market that has been underbuilt for over a decade.”

Of course, like anything else in real estate, the level of supply and demand will vary by market. Some markets may have more newly built homes, some less. But, nationally, there’s nothing to worry about. This isn’t like the last time.

No matter what you’re reading or seeing, the growing number of newly built homes on the market isn’t a red flag nationally – it's a sign builders are starting to make up for years of underbuilding. If you want to talk about what’s happening in our market, let’s connect.

Stay up to date on the latest real estate trends.

New Listing

Four 50'x100' vacant lots

Mortgage

More brand-new options are on the market right now, and builders are rolling out incentives

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

You’ve got questions and we can’t wait to answer them.