The VA Home Loan Advantage: What Every Veteran Should Know Right Now

Mortgage

Mortgage

If you’ve served in the military (or if your spouse has), you have access to one of the most powerful homebuying tools out there. The chance to buy a home without having a down payment.

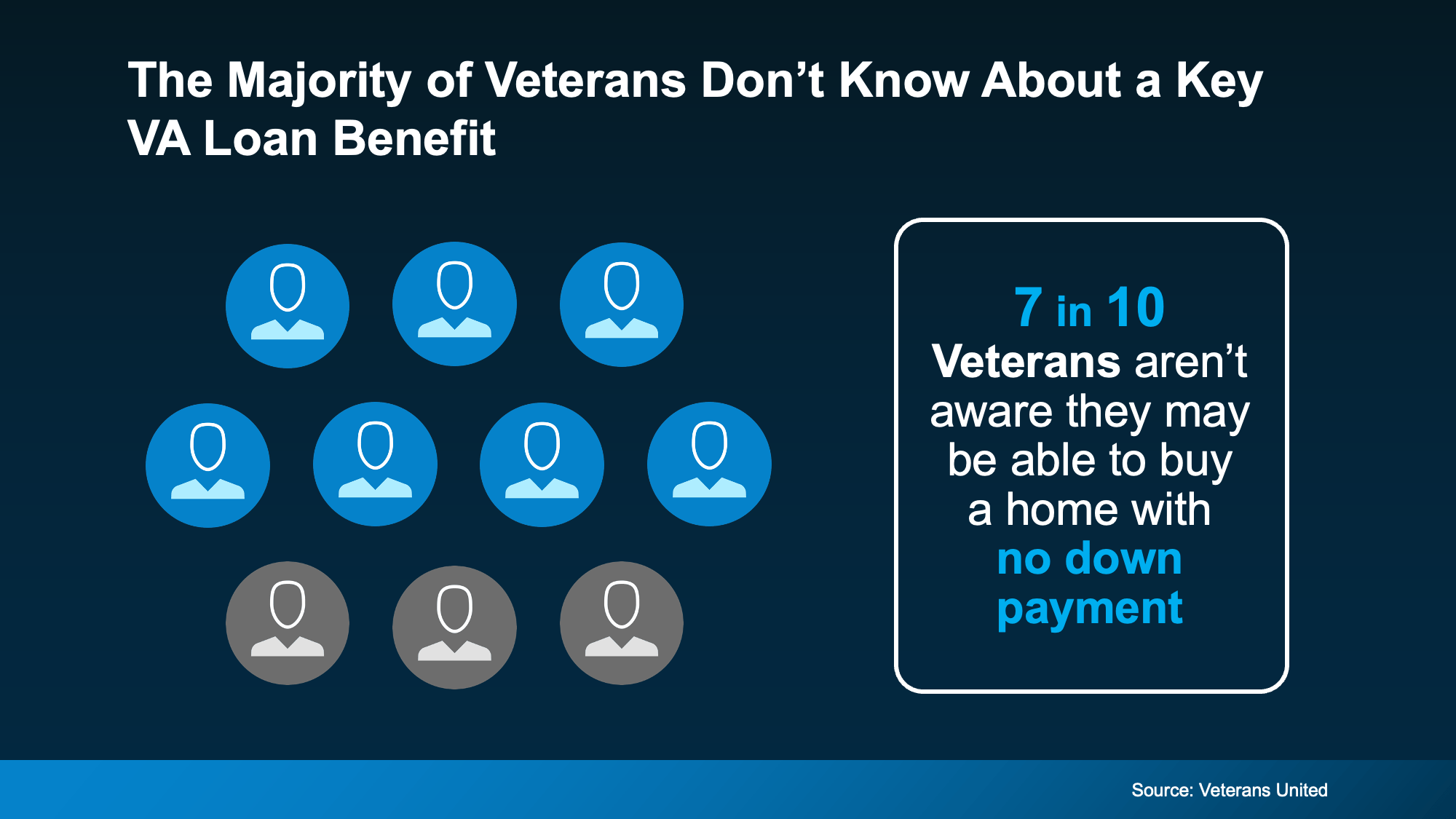

Unfortunately, 70% of Veterans (that's 7 out of every 10) don’t know about this benefit, according to Veterans United.

And that’s a big missed opportunity for those who’ve earned this benefit through service. So, let’s break down what you really need to know about Veterans Affairs (VA) home loans right now.

And that’s a big missed opportunity for those who’ve earned this benefit through service. So, let’s break down what you really need to know about Veterans Affairs (VA) home loans right now.

For nearly 80 years, VA loans have made homeownership possible for millions of Veterans and active-duty service members. Here are just a few of the top perks according to the Department of Veteran Affairs:

These features make VA loans a great way for service members (or their family) to build stability, save money, and start creating long-term wealth through homeownership.

Just remember, using your VA home loan is easier (and smoother) when you have the right team behind you. As VA News puts it:

“Choosing a military-friendly broker or agent who understands the VA home loan application process can make all the difference in the homebuying experience. Finding the right agency or brokerage is just as important as locking in a good VA mortgage lender. Communication is key to getting to the loan closing table.”

A knowledgeable agent and an experienced lender can help you navigate every step, all the way from qualifying to closing. With their help, you can make sure you’re getting the most out of your benefits.

If you’re a Veteran, a VA home loan is one of the most valuable benefits you’ve earned through your service. It offers options for no down payment, limited closing costs, and more.

Want to learn more? Talk to a lender so you can take full advantage of the benefits you’ve earned.

Stay up to date on the latest real estate trends.

Mortgage

Momentum is quietly building in the housing market.

Mortgage

Housing market conditions, your own personal situation and your finances are all things to consider.

Mortgage

Here’s what the experts are saying you have to look forward to.

Mortgage

People don’t buy homes just for financial reasons

Mortgage

In most cases, the difference typically comes down to the strategy behind the sale, not the house itself

Mortgage

The vast majority of the country is actually seeing prices rise

Mortgage

January may actually be the best time of year for budget-conscious buyers

Mortgage

The housing market hasn’t felt this energized in a long time

Mortgage

Small Flexibility, Big Payoff

You’ve got questions and we can’t wait to answer them.