What an Economic Slowdown Could Mean for the Housing Market

Mortgage

Mortgage

Talk about the economy is all over the news, and the odds of a recession are rising this year. That’s leaving a lot of people wondering what it means for the value of their home – and their buying power.

Let’s take a look at some historical data to show what’s happened in the housing market during each recession, going all the way back to the 1980s. The facts may surprise you.

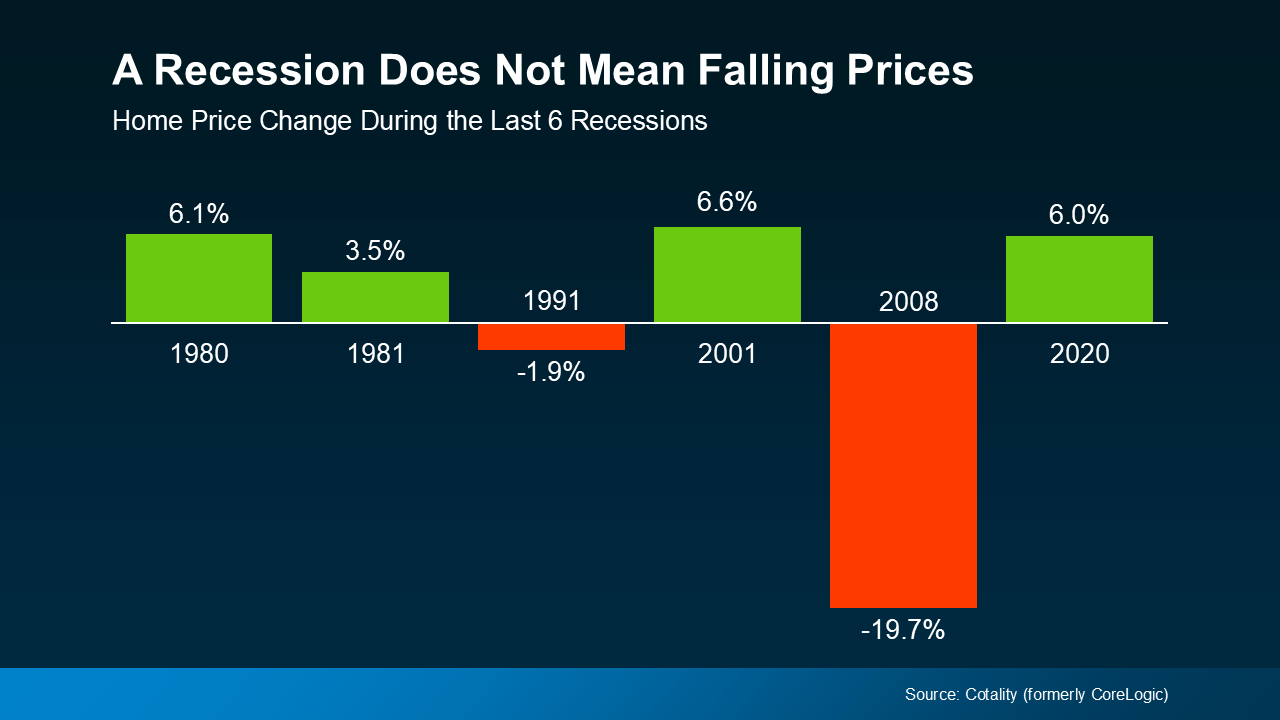

Many people think that if a recession hits, home prices will fall like they did in 2008. But that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because inventory is still so low overall. Even in markets where the number of homes for sale has started to rise this year, inventory is still far below the oversupply of homes that led up to the housing crash.

In fact, according to data from Cotality (formerly CoreLogic), in four of the last six recessions, home prices actually went up (see graph below):

So, don’t assume a recession will lead to a significant drop in home values. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising, just at a more normal pace.

So, don’t assume a recession will lead to a significant drop in home values. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising, just at a more normal pace.

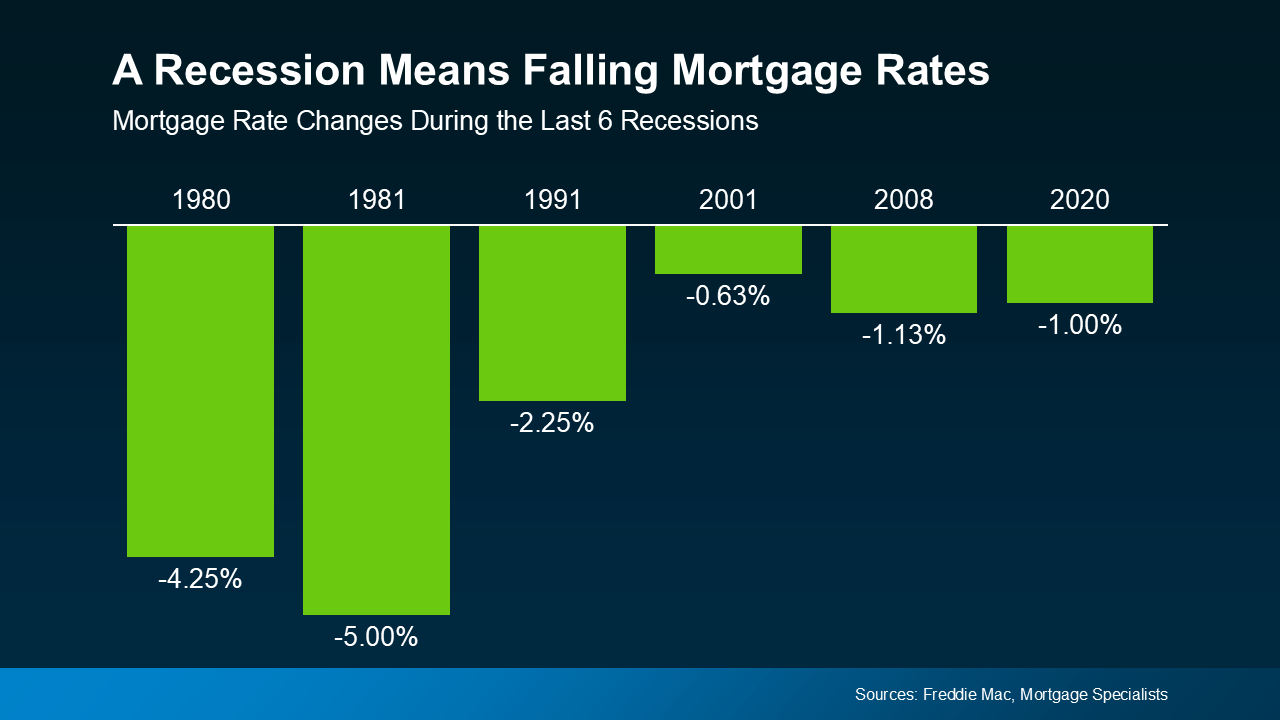

While home prices tend to stay on their current path, mortgage rates usually drop during economic slowdowns. Again, looking at data from the last six recessions, mortgage rates fell each time (see graph below):

So, a recession means rates could decline. And while that would help with your buying power, don’t expect the return of a 3% rate.

So, a recession means rates could decline. And while that would help with your buying power, don’t expect the return of a 3% rate.

The answer to the recession question is still unknown, but the odds have gone up. However, that doesn’t mean you have to worry about what it means for the housing market – or the value of your home. Historical data tells us what usually happens.

If you’re wondering how the current economy is impacting our local market, let’s connect.

Stay up to date on the latest real estate trends.

New Listing

Four 50'x100' vacant lots

Mortgage

More brand-new options are on the market right now, and builders are rolling out incentives

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

You’ve got questions and we can’t wait to answer them.