Why the Sandwich Generation Is Buying Multi-Generational Homes

Mortgage

Mortgage

Are you a part of the Sandwich Generation? According to Realtor.com, that’s a name for the roughly one in six Americans who take care of their children and their parents or grandparents at the same time.

If that sounds familiar to you, juggling all the responsibilities involved certainly must have its challenges. But it turns out there’s one pretty significant benefit: it can actually make it a bit easier for you to buy a home.

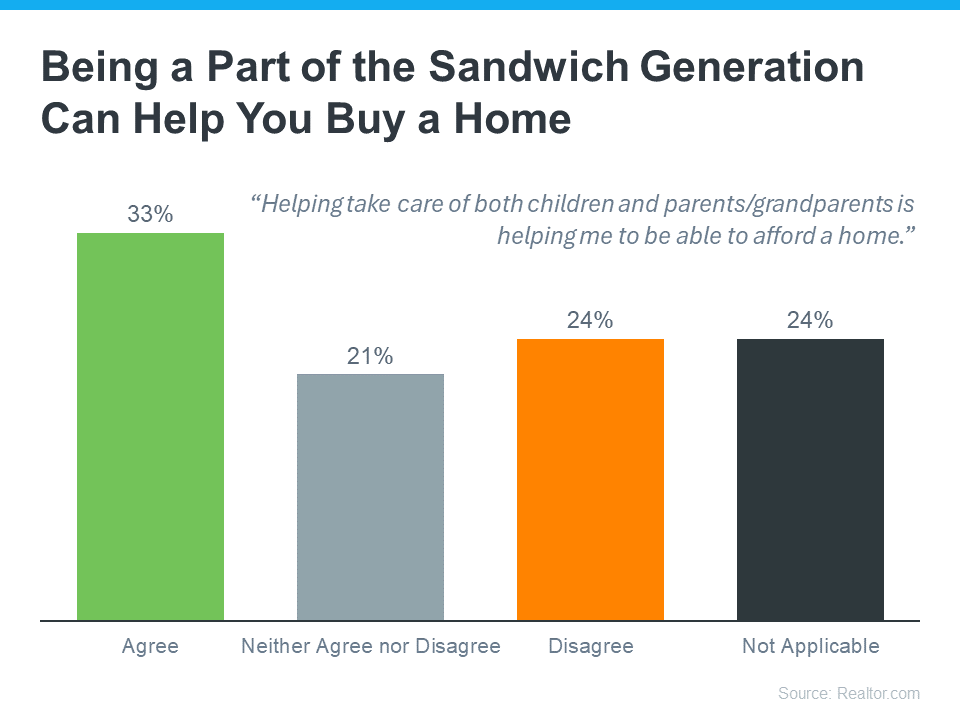

Realtor.com asked members of the Sandwich Generation if they agree or disagree that taking care of children and parents at the same time is helping them afford a home. A third of respondents said their situation made it easier to buy (see graph below):

Here are a few ways their caretaking situation might be helping those 33% buy a home:

Here are a few ways their caretaking situation might be helping those 33% buy a home:

Beyond just the financial reasons, buying a multi-generational home has other advantages. The Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) highlights some of the most popular, including:

The Mortgage Reports sums it up this way:

“Buying a house with your parents can be a great way to ease caregiving, support young children, or simply bring loved ones closer together. And considering the steep rise in home prices over the last few years, it can make homeownership a lot more affordable.”

If you’re in the Sandwich Generation and thinking about buying a multi-generational home, working with a local real estate agent is essential. Finding a home that works for so many people can be tricky. An agent will use their expertise to help you find one that meets the needs of, and has enough space for, everyone who’s going to live there.

Being a part of the Sandwich Generation comes with its challenges – but it also might come with one truly great perk. If you’re looking to buy a home, your caregiving situation can actually make it a bit easier for you to afford a home. To learn more, let’s connect.

Stay up to date on the latest real estate trends.

New Listing

4 beds | 3 full baths | 2,854 sq ft

New Listing

4 beds | 3 baths | 2,610 sq ft

New Listing

4 beds | 3.5 baths | 3,398 sq ft

Mortgage

It could mean paying less, dealing with less stress, and feeling less rushed

Mortgage

Affordability Is Finally Moving in the Right Direction

Mortgage

Don’t forget to plan ahead for your homeowner’s insurance

New Listing

2 bedrooms | 1 bathroom | 617 sq ft

Mortgage

Nearly 12,000 people will turn 65 every day for the next two years

Mortgage

The housing market in 2026 isn’t one-size-fits-all. It’s a year where local conditions matter more than ever.

You’ve got questions and we can’t wait to answer them.