You Could Use Some of Your Equity To Give Your Children the Gift of Home

Mortgage

Mortgage

If you’re a homeowner, chances are you’ve built up a lot of wealth – just by living in your house and watching its value grow over time. And that equity? It’s something that could help change your child’s life.

Since affordability is still a challenge, a lot of first-time buyers are struggling to buy a home in today’s market. Even if they have a stable job and a solid plan, buying can still feel out of reach. But that’s where your equity could make all the difference.

To give you an idea, the average homeowner with a mortgage has $311,000 worth of equity, according to Cotality (formerly CoreLogic). That’s significant. And some parents are using a portion of their equity to help their children become homeowners, too.

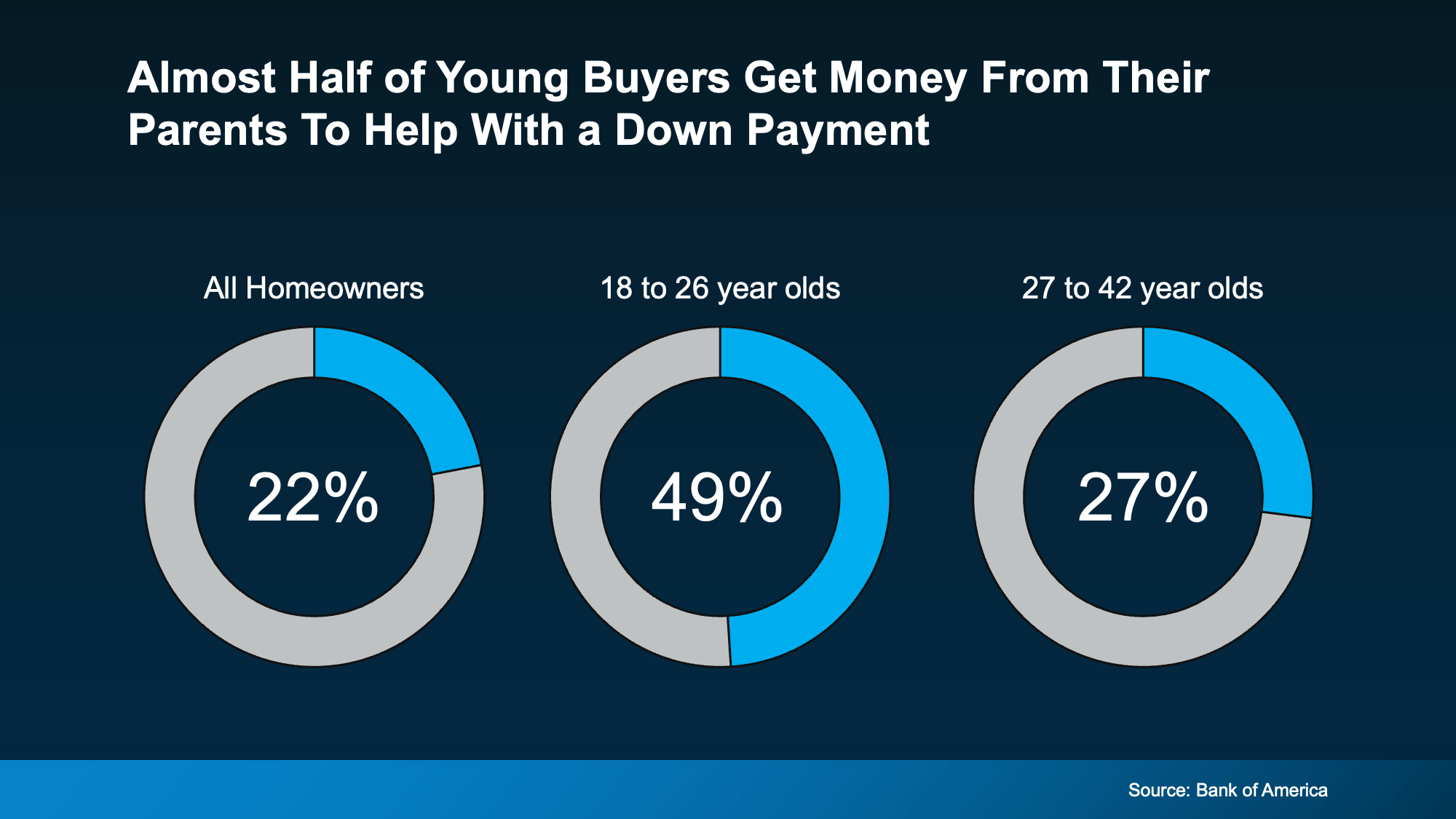

According to Bank of America, 49% of buyers between 18 and 26 got money from their parents to use toward their down payment (see chart below):

Even though the data doesn’t specify how many parents used their equity, the wealth they’ve built through homeownership may have helped make it possible – especially given how much equity the average homeowner has today.

Even though the data doesn’t specify how many parents used their equity, the wealth they’ve built through homeownership may have helped make it possible – especially given how much equity the average homeowner has today.

While what’s right for each person’s specific situation will vary on a case-by-case basis, that’s a powerful legacy to pass on. It helps those younger people buy a home, build equity of their own, and begin the next chapter of their life with a little less financial stress and a lot more stability. And for those parents? It’s a way to turn what they've built into something deeply meaningful.

This isn’t just about money. For many homeowners, it’s about being the reason their child gets to say, “we got the house.” And giving them the kind of head start they might’ve only dreamed of at their age. And here’s the part that really sticks. Compare the Market says:

“Of those who did receive monetary aid from parents and grandparents to buy a house, 45% of Americans said they would not have been able to purchase a house without financial support from parents and grandparents.”

Your equity could be the thing that makes homeownership possible for your children when they might not be able to do it on their own. So, here’s the question.

If helping your kids buy a home was more feasible than you thought, would you want to explore that option?

If you want to learn more or find out the best way to make it happen, talk to your lender and a financial advisor you trust.

Stay up to date on the latest real estate trends.

Mortgage

According to Realtor.com, this October will have the most buyer-friendly conditions of any month in 2025

Mortgage

Both of the top concerns for buyers are seeing some movement

Mortgage

Knowing your numbers can go a long way and help you feel confident about your purchase

Mortgage

Let’s talk about what your house is worth, and what it could unlock for you today.

New Listing

3 beds + den | 2 baths | 2,880 sq ft

Mortgage

What really matters is what’s happening in your town and your neighborhood.

Event

🏡 Trust Us, This Will Be Fun! 🏡

Mortgage

Lower rates, slower price growth, and stronger wages might make the numbers finally work for you this fall.

New Listing

4 beds | 2.5 baths | 2,678 sq ft

You’ve got questions and we can’t wait to answer them.