The Surprising Amount of Home Equity You’ve Gained over the Years

Mortgage

Mortgage

There are a number of reasons you may be thinking about selling your house. And as you weigh your options, you may find you’re unsure how you’re going to deal with one thing about today’s housing market – and that’s affordability. If that’s your biggest concern, understanding how much equity you have in your house could help make your decision that much easier. Here are two key factors that have a big impact on your equity.

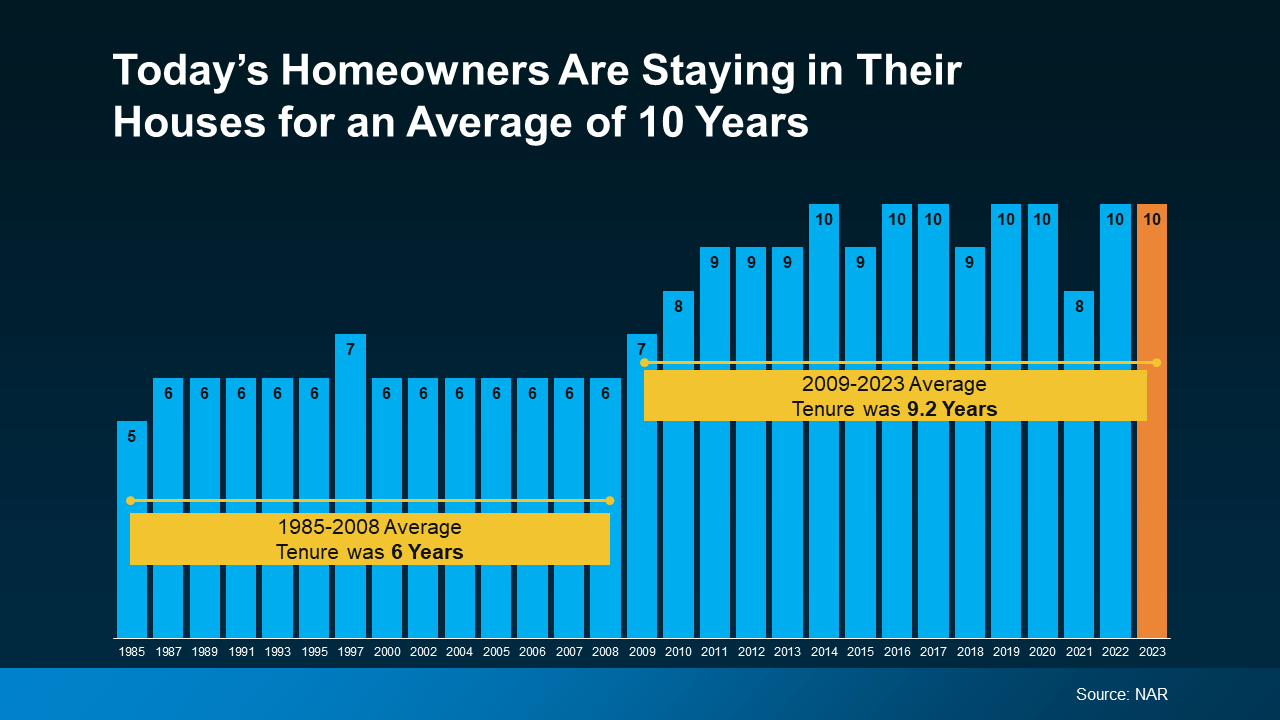

First up is homeowner tenure. That’s how long homeowners live in a house, on average, before selling or choosing to move. From 1985 to 2009, the average length of time homeowners stayed put was roughly six years.

But according to the National Association of Realtors (NAR), that number has been climbing. Now, the average tenure is 10 years (see graph below):

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

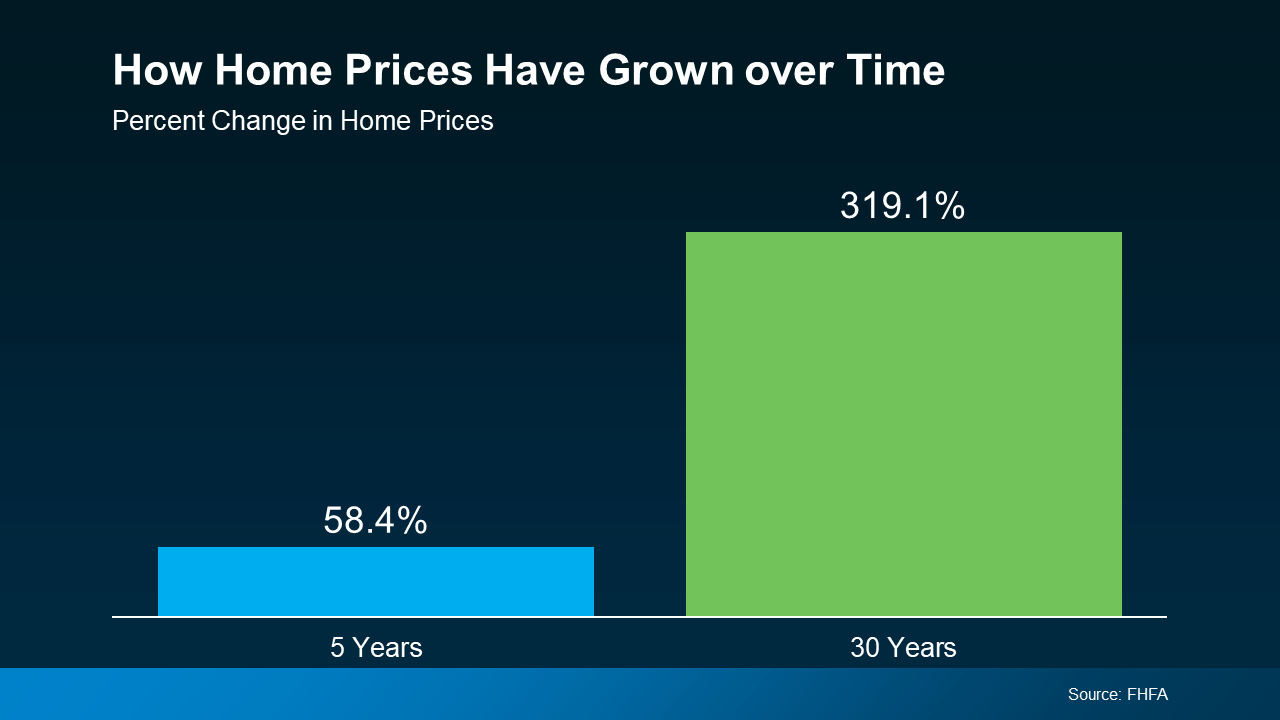

To help show how much the price appreciation piece adds up, take a look at this data from the Federal Housing Finance Agency (FHFA) (see graph below):

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you can live closer to friends or loved ones, your equity can be a game changer.

If you want to find out how much equity you’ve built up over the years and how you can use it to buy your next home, let’s connect.

Stay up to date on the latest real estate trends.

New Listing

Four 50'x100' vacant lots

Mortgage

More brand-new options are on the market right now, and builders are rolling out incentives

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

You’ve got questions and we can’t wait to answer them.