What You Should Know About Getting a Mortgage Today

Mortgage

Mortgage

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to get a bit more achievable, but lending standards are still strong.

Lenders are making it slightly easier for well-qualified buyers to access financing, which is opening more doors for people ready to make a move.

So, if strict requirements were holding you back, this shift could be the opportunity you’ve been waiting for, without repeating the risky lending practices that led to the housing crash back in 2008.

Banks are offering credit to more people in an effort to boost activity in the housing market, including buyers who have lower credit scores or smaller down payments. And that means more people are getting approved for mortgages.

But it doesn’t mean we’re heading for another crash like 2008. Even with the slight easing lately, lending standards today are still much tighter than they were back then.

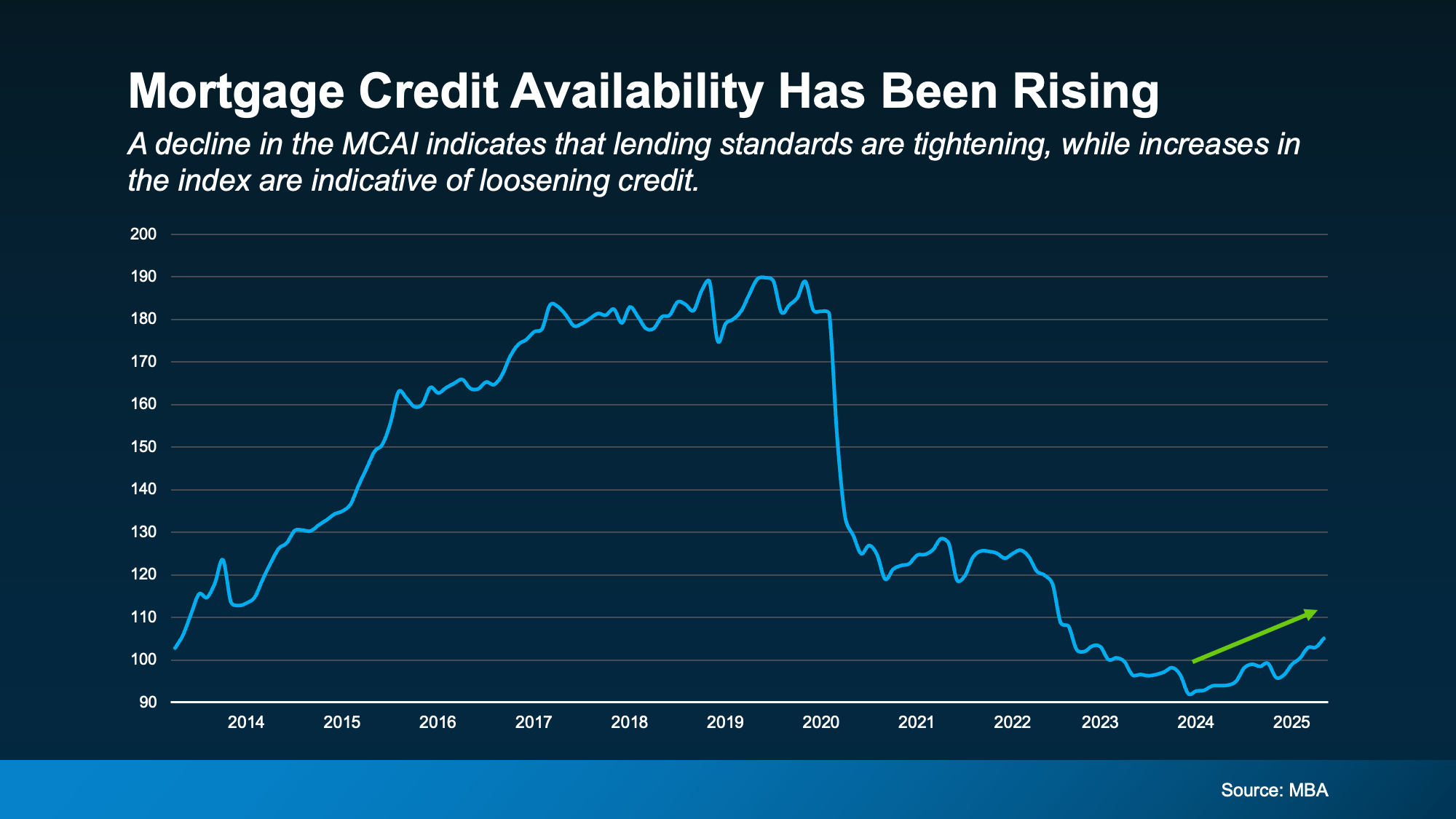

According to the Mortgage Bankers Association (MBA), the Mortgage Credit Availability Index (MCAI) has been going up. This index shows how easy or hard it is for people to get a mortgage.

When the index rises, it means banks are easing their lending standards. And in May, credit availability hit its highest point in almost three years (see graph below):

Why does this matter to you? It means you may now be able to qualify for a mortgage that you wouldn’t have just a few months ago. The National Association of Underwriters (NAMU) explains:

Why does this matter to you? It means you may now be able to qualify for a mortgage that you wouldn’t have just a few months ago. The National Association of Underwriters (NAMU) explains:

“Mortgage credit availability surged in May, reaching its highest level since August 2022. The uptick signals that lenders are increasingly willing to loosen underwriting standards, providing borrowers with greater access to financing options . . .”

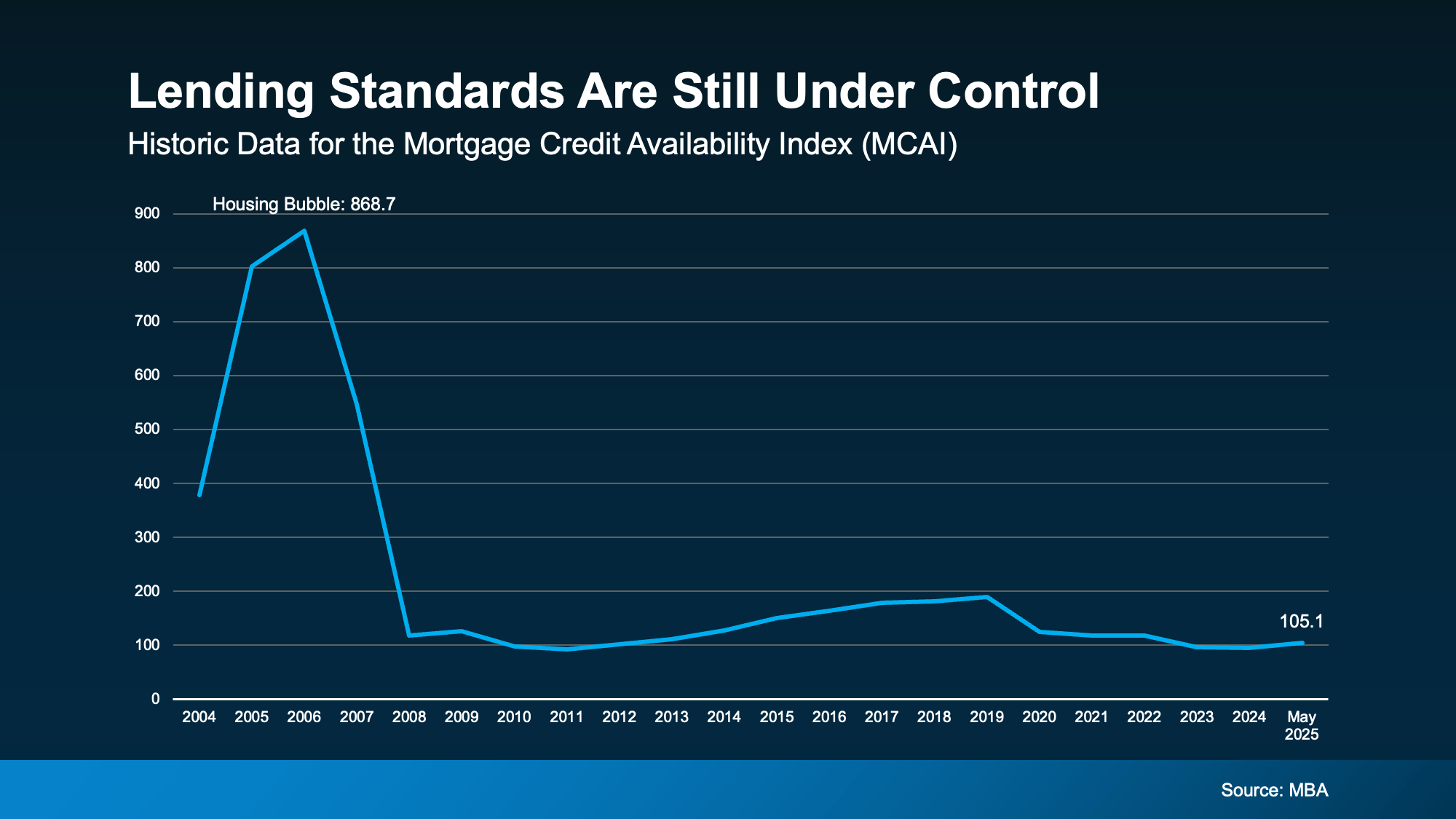

Now, you might be thinking, “Didn’t looser lending standards play a role in the 2008 housing crash?” That’s a smart question – and an important one. But here’s the difference. While credit availability is rising, lending standards are still under control.

Based on MCAI data going all the way back to 2004, today’s lending levels are still way below what they were leading up to the housing bubble (see graph below):

So, increasing mortgage credit availability right now isn’t a concern. It’s just a good thing for anyone looking to buy a home. As Brett Hively, SVP of Mortgage, Finance, and Strategy at Ameris Bancorp, recently said:

So, increasing mortgage credit availability right now isn’t a concern. It’s just a good thing for anyone looking to buy a home. As Brett Hively, SVP of Mortgage, Finance, and Strategy at Ameris Bancorp, recently said:

“This uptick is opening the door for many borrowers to move forward with a home purchase or a refinance program.”

So, if you’ve been holding back because you thought you couldn’t get approved for a mortgage, it’s worth finding out what’s possible today. Let’s talk with a lender about your options and see if you’re ready to take that next step toward homeownership.

Stay up to date on the latest real estate trends.

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

Mortgage

Most Americans think a recession is coming. But most experts don’t.

Mortgage

The listings that didn’t sell this year weren’t doomed. They just started with the wrong strategy.

You’ve got questions and we can’t wait to answer them.