Why a Condo Could Be Your Perfect First Home

Mortgage

Mortgage

If you’re looking to break into homeownership but the price of single-family homes has you second-guessing, you might want to consider a condominium (condo) or townhome. These types of homes often come with a lower barrier to entry – and that can help you start to build equity and enjoy the benefits of owning a home sooner.

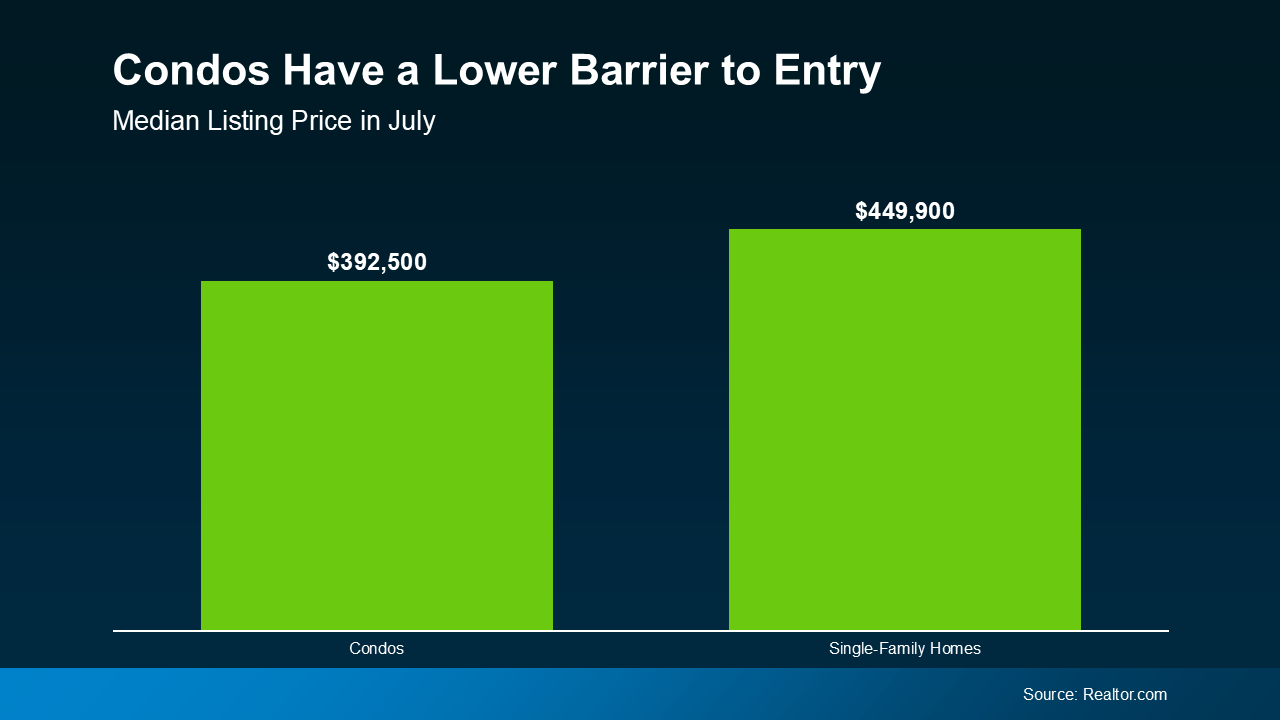

Since they're usually smaller than single-family homes, they can be easier on your wallet. While it’s not always the case, smaller square footage usually comes with a smaller price tag too. As a result, according to the latest data from Realtor.com, condos typically have a lower asking price than single-family homes (see graph below):

And here’s some exciting news: builders are focusing more on homes like these. The National Association of Home Builders (NAHB) says:

And here’s some exciting news: builders are focusing more on homes like these. The National Association of Home Builders (NAHB) says:

“The share of townhomes being built is at an all-time high.”

That means there’s a good number of options to add to your home search if you broaden it to include condos and townhomes. And you may even find something that works better for your budget.

So, if you're comfortable with a smaller space and want to buy your first home before the spring rush, adding these types of homes to your search might be your answer.

Living in a condo has a bunch of other perks, too. Let’s look closer at why condos are appealing for first-time buyers:

Remember, your first home doesn't have to be the one you stay in forever. The important thing is to get your foot in the door as a homeowner so you can start to gain home equity. Later on, that equity can help you buy another place if you want something different.

Ultimately, owning and living in a condo or townhome is a lifestyle choice. If you want to see if it makes sense for you, talk to a local real estate agent.

Ready to find a home that suits your goals? A condo might be the perfect fit for your first home purchase. Let’s connect today to start your search.

Stay up to date on the latest real estate trends.

New Listing

Four 50'x100' vacant lots

Mortgage

More brand-new options are on the market right now, and builders are rolling out incentives

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

You’ve got questions and we can’t wait to answer them.