The Reason Homes Feel Like They Cost So Much (It’s Not What You Think)

Mortgage

Mortgage

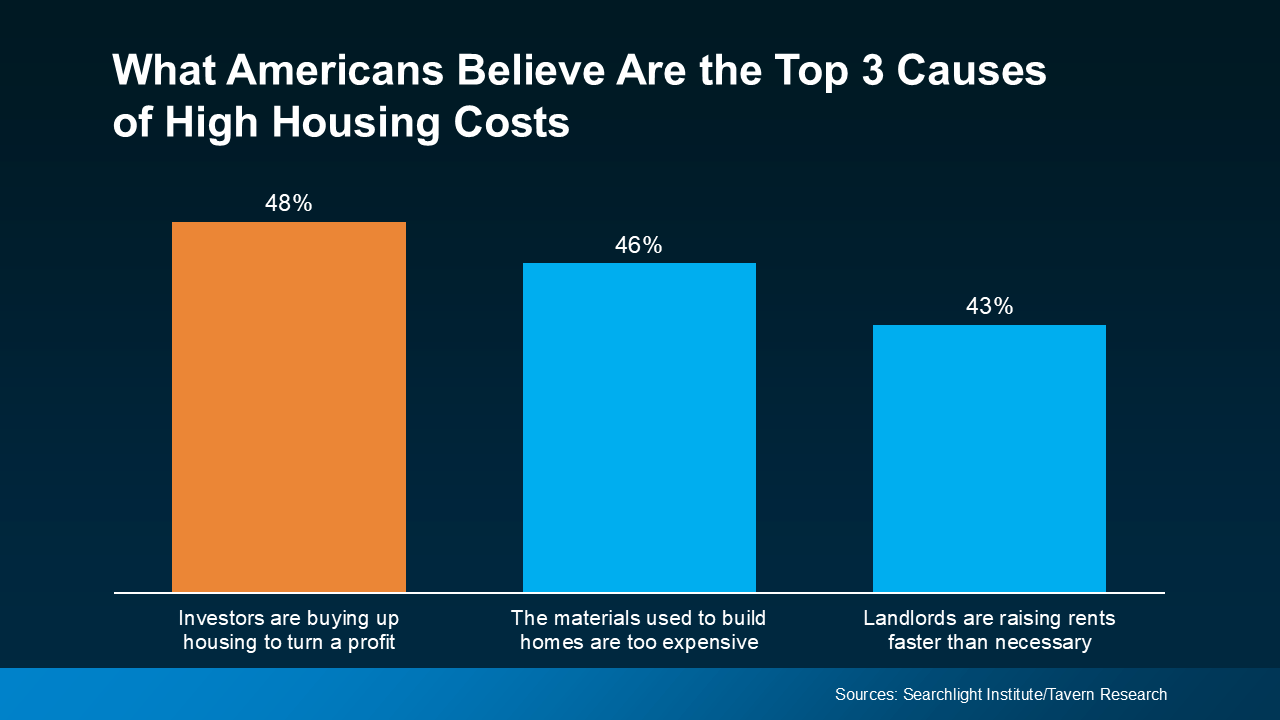

Scroll through your feed and you’ll see plenty of finger-pointing about why homes cost so much. And according to a national survey, a lot of people believe big investors are to blame.

Even though data shows that’s not true, nearly half of Americans surveyed (48%) think investors are the top reason housing feels so expensive (see graph below):

But that theory doesn’t actually hold up once you look at the data.

But that theory doesn’t actually hold up once you look at the data.

Investors do play a role in the housing market, especially in certain areas. But they’re not buying up all the homes like so many people on social media say.

Nationwide, Realtor.com found only 2.8% of all home purchases last year were made by big investors (who own more than 50 properties). That means roughly 97% of homes were bought and sold by regular people, not corporate giants. Danielle Hale, Chief Economist at Realtor.com, explains:

“Investors do own significant shares of the housing stock in some neighborhoods, but nationwide, the share of investor-owned housing is not a major concern.”

So, if it’s not investors, why are home prices so high?

The real story behind rising prices has less to do with who’s buying and more to do with what’s missing: enough homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), says:

"It's been popular among some to blame investors, but with housing, the economics of that don't make a lot of sense. The fundamental driver of housing costs is the shortage itself—it's driven by the fact that there's a mismatch between the number of households and the actual size of the housing stock."

There simply haven’t been enough homes for sale to meet buyer demand. And that shortage, not investor activity, is what’s pushed prices higher just about everywhere.

It’s easy to believe investors caused today’s housing challenges. But the truth is, the market just needs more homes, and that’s finally starting to happen.

As more options hit the market, buying may feel a little more realistic again.

Let’s connect and talk about what’s happening in our local market.

Stay up to date on the latest real estate trends.

New Listing

2 beds + bonus | 1.5 baths | 1,582 sq ft

Mortgage

A great rate won’t make up for a home that no longer works for you

Mortgage

If you want to understand what these trends mean for your goals, let’s connect and walk through it together

Mortgage

The homes that have been sitting a little longer could be your best opportunity to save

Mortgage

Your next home could bring you more space, more connection, and more happiness than you think

Mortgage

With affordability starting to improve, the path to homeownership may be opening up more than you think

Mortgage

Waiting until 2026 to sell your house could mean missing out on a great window of opportunity

Mortgage

Most Americans think a recession is coming. But most experts don’t.

Mortgage

The listings that didn’t sell this year weren’t doomed. They just started with the wrong strategy.

You’ve got questions and we can’t wait to answer them.